The Road Ahead

By Rob Sigler, MBA

July 19, 2023

Are we headed into recession or continuing recovery? Are we entering a new bull market or is this simply a bear market rally? Will inflation remain stubbornly high or will it continue to decrement quickly? Is the Federal Reserve done tightening monetary policy or do they have more to go? Are equities a buy up here or should we take profit? Will bonds ever recover or will higher interest rates persist? Should we sell everything and move to cash with these elevated money market yields? With no shortage of opinions on the direction of economic growth and the performance of various asset classes, not to mention plenty of cross-currents in the data to make it thoroughly confusing, we assembled a pictorial to help cut through the cacophony and illustrate Westshore Wealth’s views.

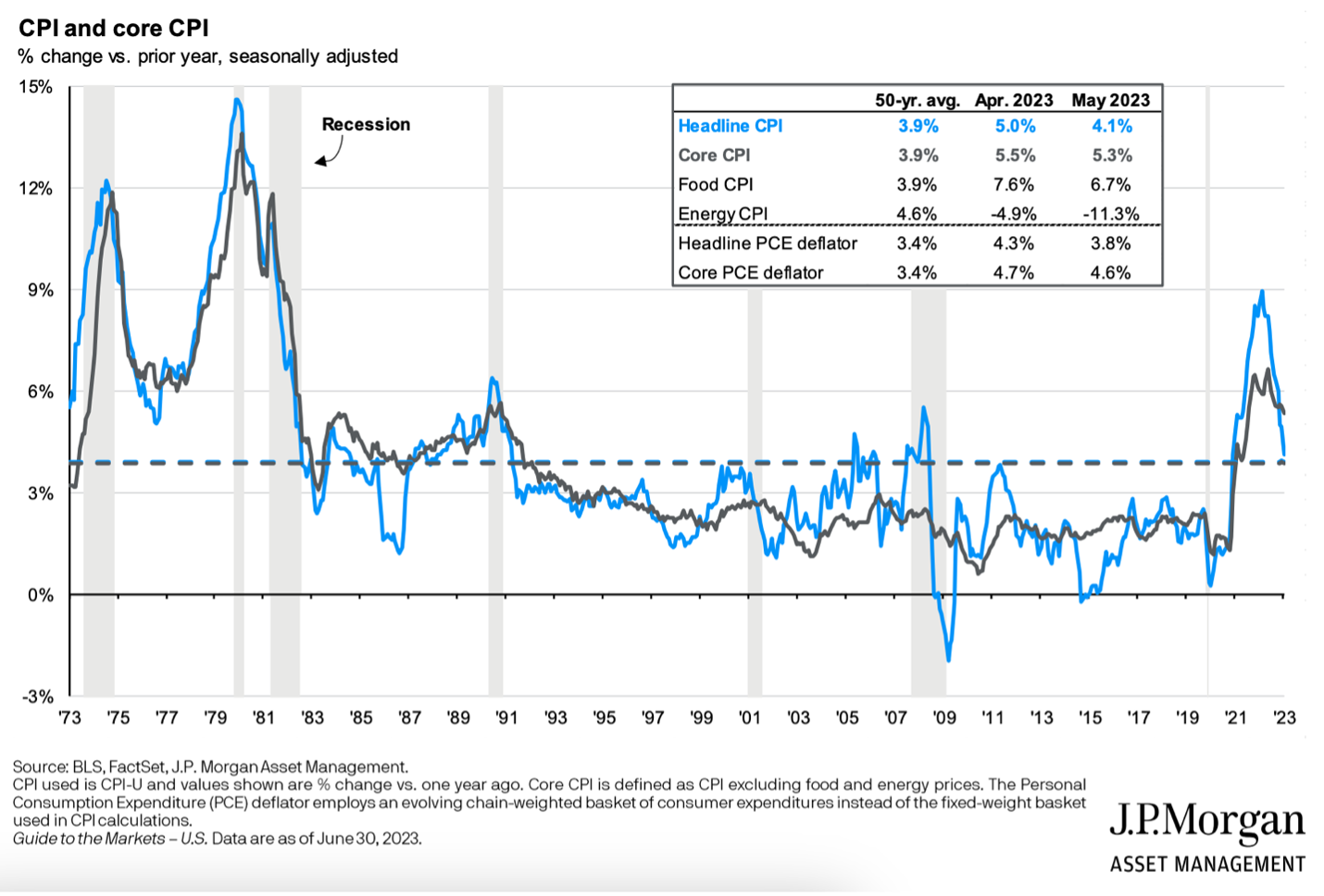

Let us start with the easy part. We have been arguing for some time that inflation was going to make a hasty retreat and that this spike would not have the lasting scars that we saw during the 1979 – 1981 period, nor require the same Federal Reserve response. That appears to be the case. Headline inflation, as measured by the Consumer Price Index (CPI), has now fallen in each of the past 12 months and now resides at 3%. While still above the Federal Reserve’s 2% target rate, we should continue to march toward goal as the lags inherent in housing inflation play out. As that becomes move evident, the imperative to raise interest rates will cease. This is tremendously important as inflection points in Federal Reserve policy tend to usher in much better return periods for stocks and bonds alike (more on this point later).

So, are we off to the races? Unfortunately, like everything in life, it is never that simple. To date, Federal Reserve tightening seems to have had little impact on the economy. Job growth has been robust, consumer spending has held up, and traditionally interest rate sensitive categories like automobile and housing purchases have remained resolutely strong. Finally, with incredibly low expectations modeled for 2Q23 corporate earnings (analysts model S&P 500 eps down 9%), companies are apt to significantly exceed consensus forecasts. All good news, right? Yes and no.

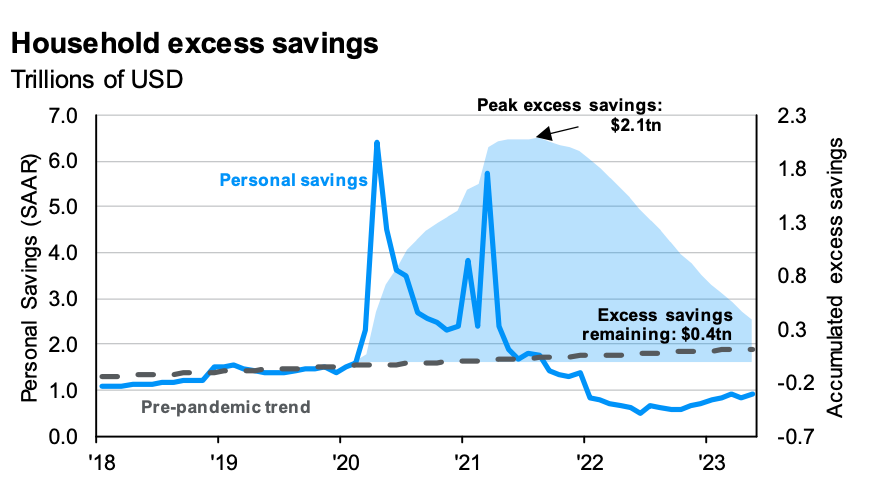

It is our contention that interest hikes are having their traditional arresting impacts on the economy, but the structural lags between implementation and the effect on growth has lengthened this cycle. Why? The pandemic was an unusual period to say the least. Consumers did not have a chance to spend money on traditional discretionary purchases like leisure travel, restaurant visits, concerts and moviegoing. At the same time, the Federal Government flooded the system with fiscal programs to augment income. The combination resulted in one of the largest spikes in personal savings in our history (at peak, excess savings crested at $2.1T). We have consumed roughly 75% of that excess pool thus far, and will largely exhausted it by the conclusion of 2023.

Source: BEA, Federal Reserve, JP Morgan Asset Management

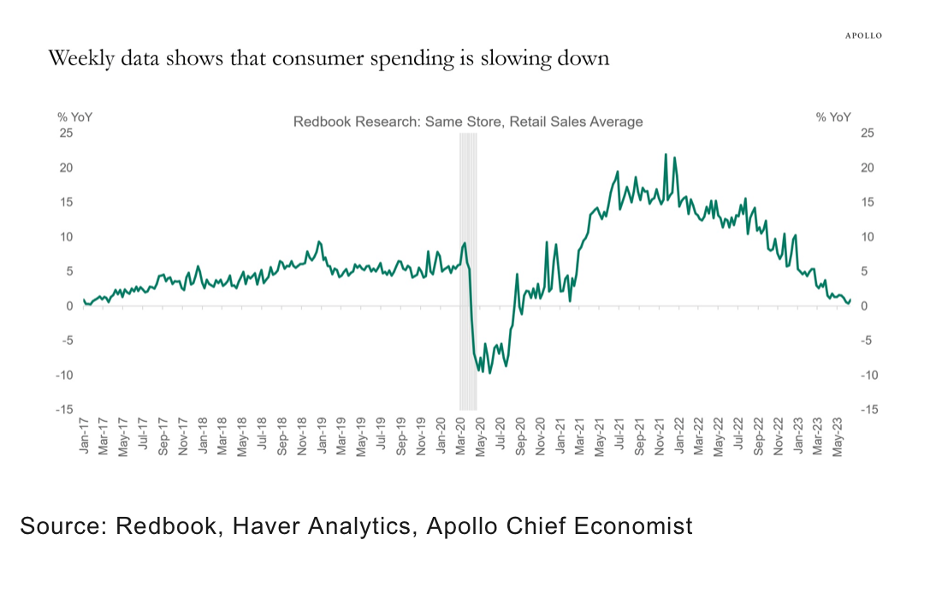

Why is that important? As we do so, we contend that the impacts on the economy will be felt more profoundly. And by the way, it is already happening and apparent in the data. For example, consumer spending is starting to hit the brakes.

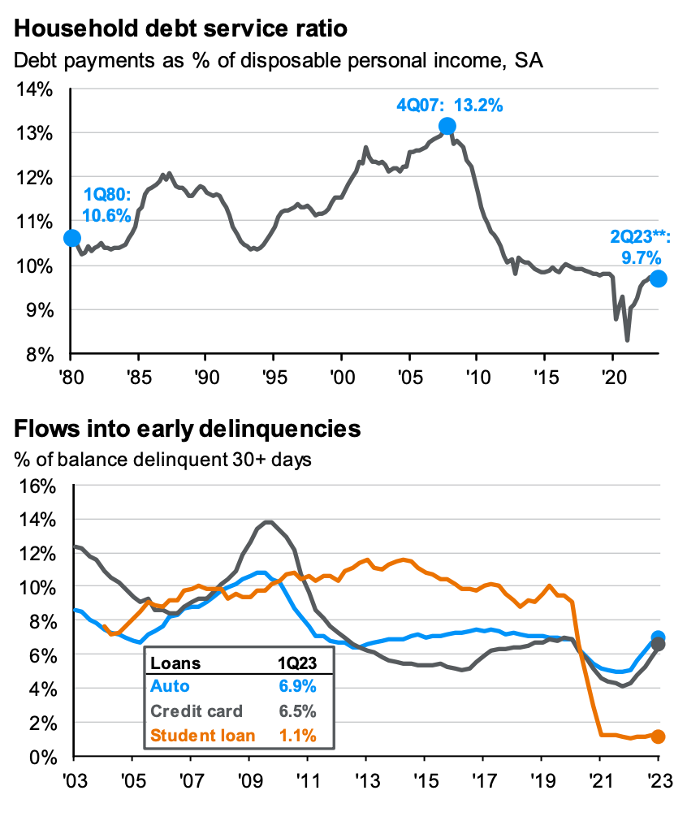

Signs of stress are starting to emerge. Not only is household debt service now consuming a greater proportion of disposable income, but delinquencies are starting to rise in credit cards and automobile loans.

Signs of stress are starting to emerge. Not only is household debt service now consuming a greater proportion of disposable income, but delinquencies are starting to rise in credit cards and automobile loans.

Source: Factset, Federal Reserve Board, JP Morgan Asset Management

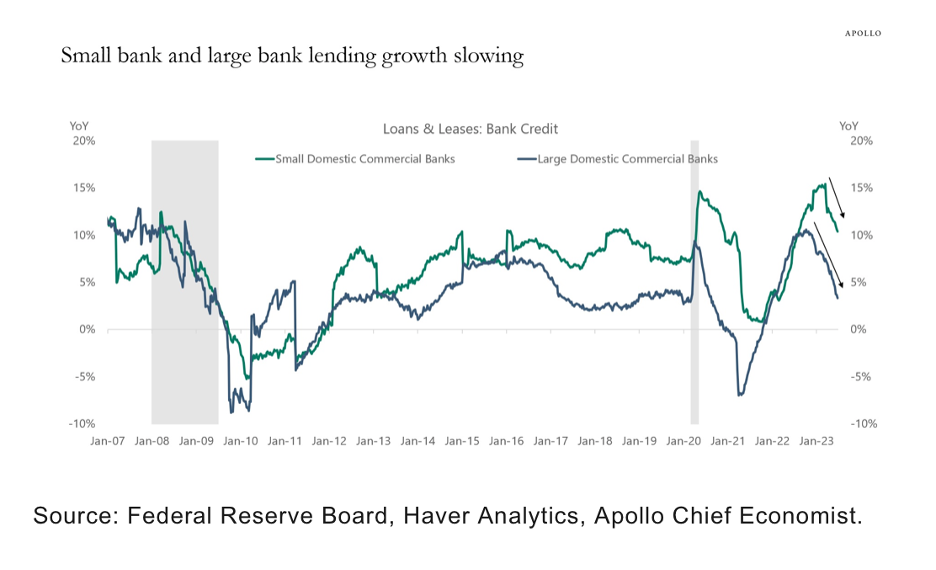

Meanwhile, credit conditions continue to tighten and bank lending is slowing dramatically. As a result, companies will find it increasingly more expensive to borrow and hurdle rates for capital investment will go up. For companies that are overindebted, cash flow constraints may force them to seek restructurings and/or bankruptcy protection. We see that very clearly in the weekly filing data.

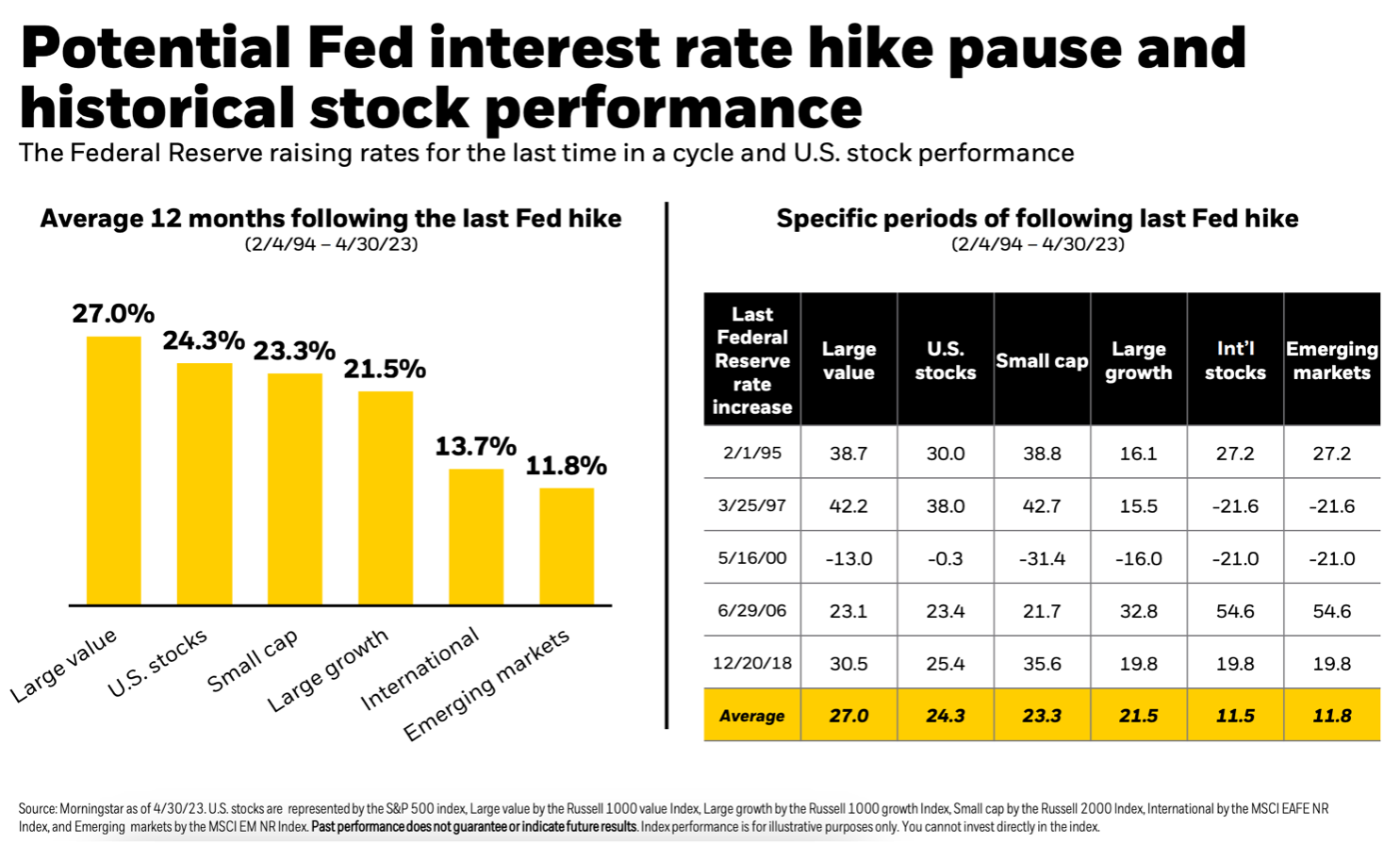

Bottom line, we want our clients to understand that economic data is likely to get softer in the coming months ahead, not to the point of severe contraction, but enough to have investors question whether the US will dip into recession. Now, here is the perverse part. That is not horrible news. Could it cause some volatility in equity markets in the short run? Of course. That would not be unexpected. However, softer data is a necessary signpost. The Federal Reserve wants to see weaker economic data to know that its monetary tightening cycle is having the desired impact. They want to kill inflationary forces and firmly anchor future inflation expectations. If the data starts to weaken modestly, they can simply go into hibernation mode. If the data weakens materially, they will reverse course and start an easing cycle. Either way, the equity and fixed income market would welcome this shift over the medium term and thus we believe any market upset would be short-lived. Consider the following two charts. Stocks have tended to rally sharply as the Fed pauses.

Bottom line, we want our clients to understand that economic data is likely to get softer in the coming months ahead, not to the point of severe contraction, but enough to have investors question whether the US will dip into recession. Now, here is the perverse part. That is not horrible news. Could it cause some volatility in equity markets in the short run? Of course. That would not be unexpected. However, softer data is a necessary signpost. The Federal Reserve wants to see weaker economic data to know that its monetary tightening cycle is having the desired impact. They want to kill inflationary forces and firmly anchor future inflation expectations. If the data starts to weaken modestly, they can simply go into hibernation mode. If the data weakens materially, they will reverse course and start an easing cycle. Either way, the equity and fixed income market would welcome this shift over the medium term and thus we believe any market upset would be short-lived. Consider the following two charts. Stocks have tended to rally sharply as the Fed pauses.

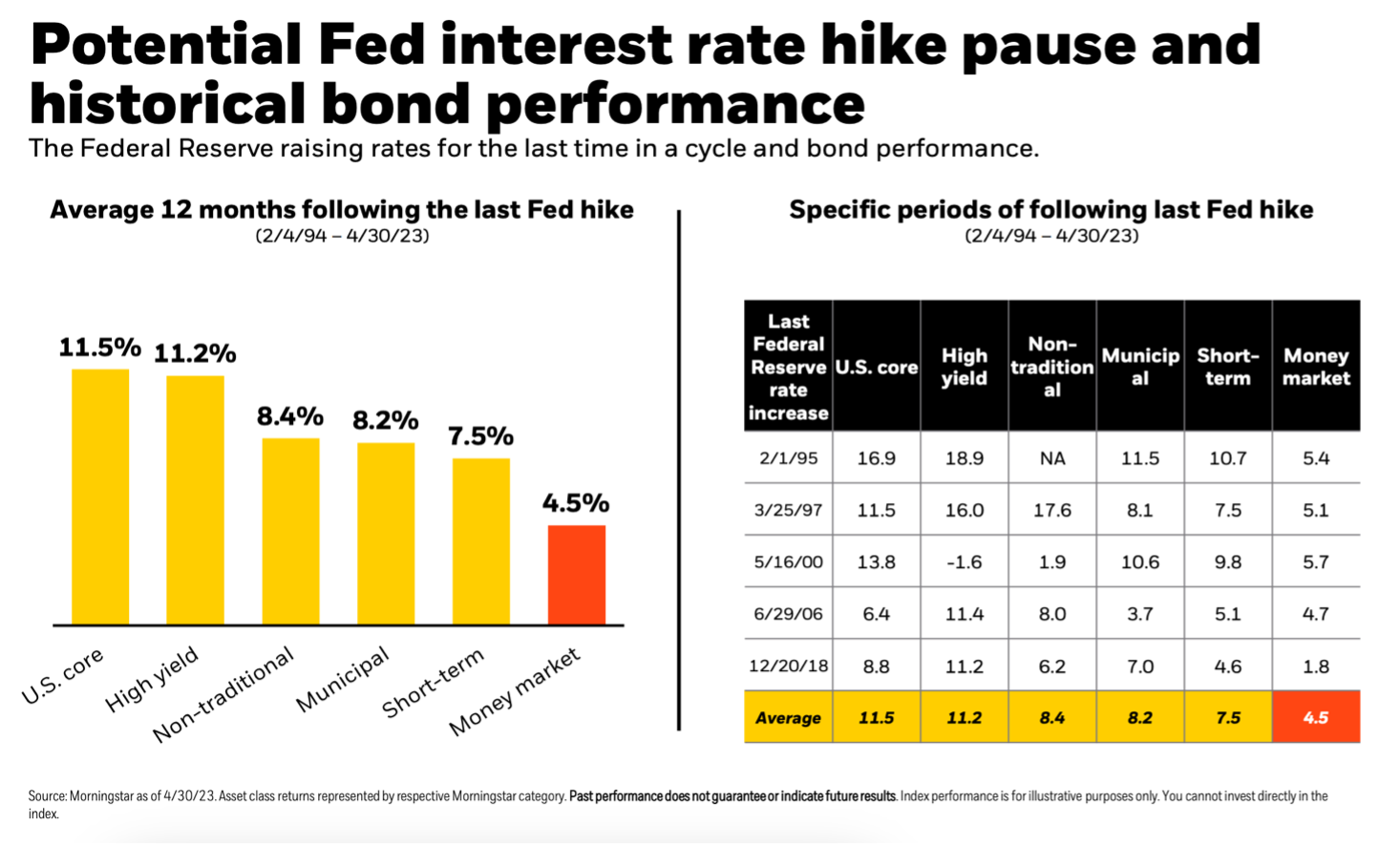

The same can be said for bonds.

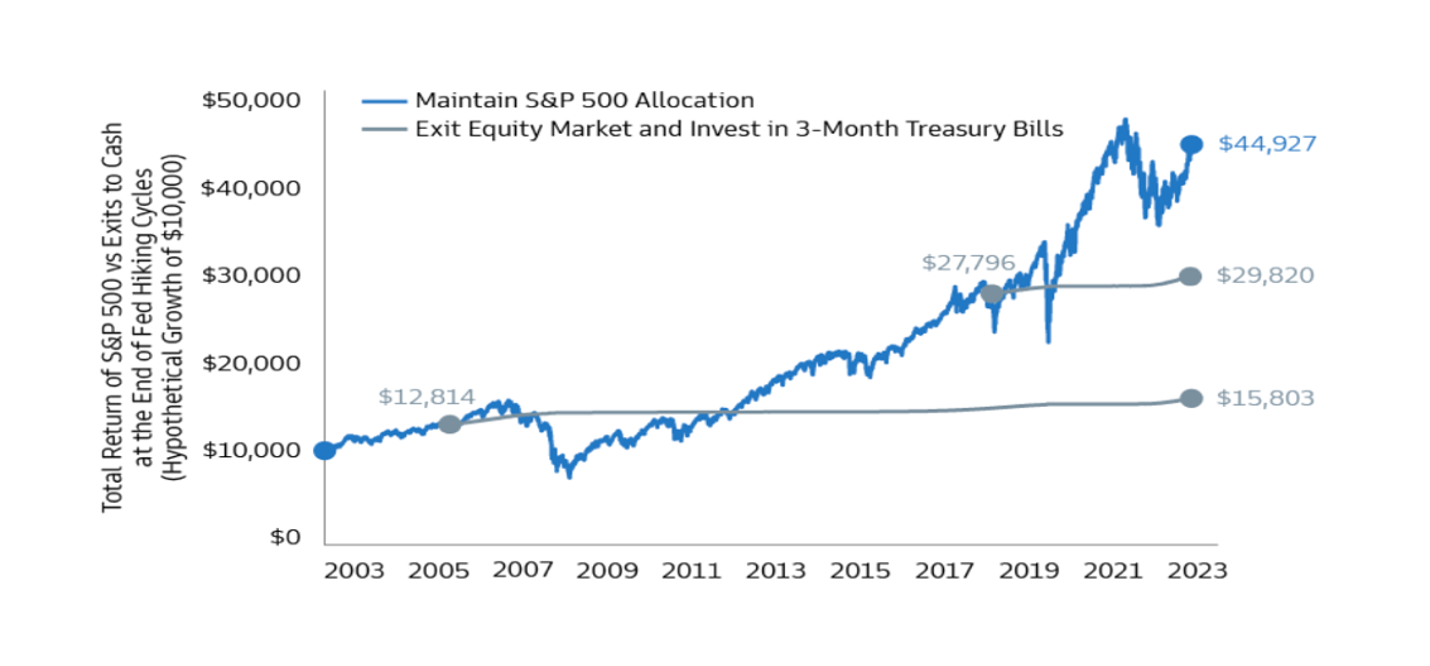

And for those of you who think I am crazy; the usual question that I field is why don’t we simply hide out in money market funds until all these issues are resolved? Why be a hero? After all, money market funds are paying out nearly 5% per annum. The answer is simple. The cost of being out of the market is material if we get our timing wrong. The illustration below shows how a decision to exit equities at the peak in money market rates has historically been a poor one (the blue line maintained equity exposure while the grey line swapped into money markets).

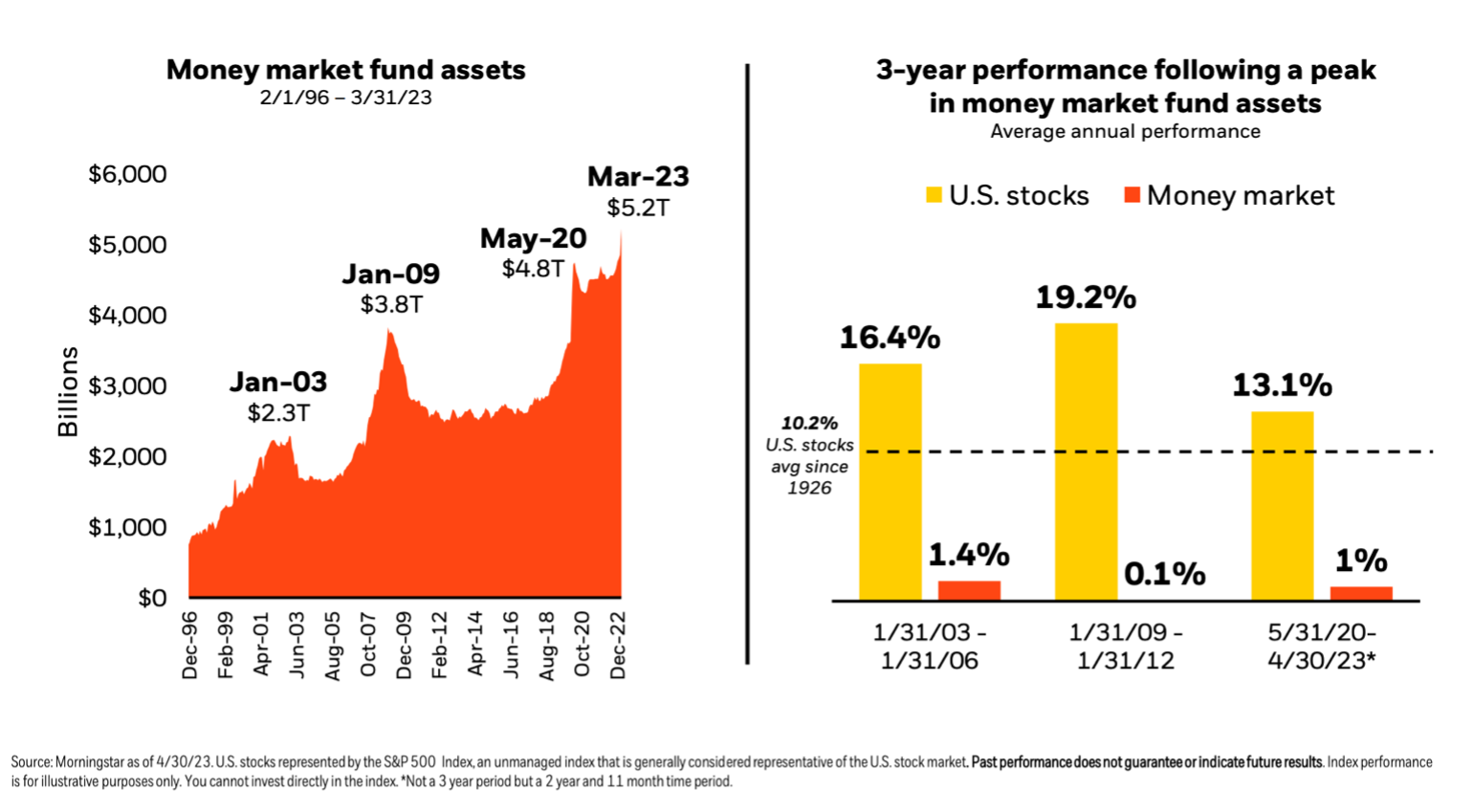

The reality is that a huge proportion of individual investors has already voted with their feet and are cautiously position. Money market funds have accumulated $5.2 trillion in assets under management. That is $400 billion higher than the peak during the pandemic (when the S&P 500 index fell under 2200). For context, the entire market capitalization of all stocks comprising the New York Stock Exchange is $22 trillion. In other words, nearly ¼ of the equity market is now sitting on the sidelines. As investors regain confidence, they will deploy those monies. As the chart on the right depicts, the redeployment of idle cash has produced rather significant 3 year returns in equities. We do not want to miss that wave.

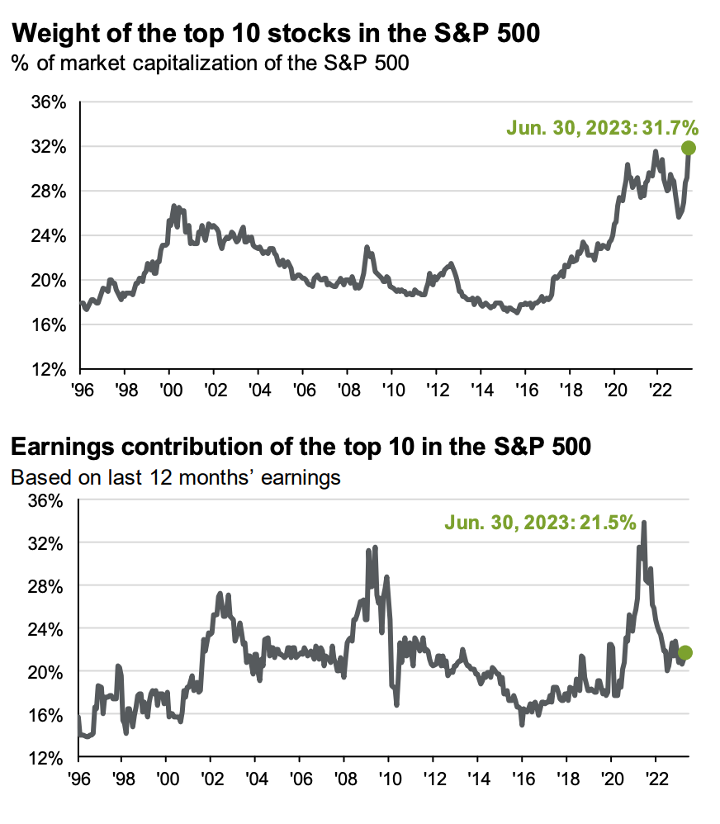

So where are we finding opportunities? The current equity rally has been rather unusual thus far. It has been fueled by mega capitalization securities and has largely been confined to growth-oriented names within the technology and communication services sectors. As you can see below, we are starting to get quite top-heavy. The top 10 names within the S&P 500 now account for 31.7% of S&P 500 while contributing only 21.5% of the earnings.

Source: Factset, Standard & Poor’s, JP Morgan Asset Management

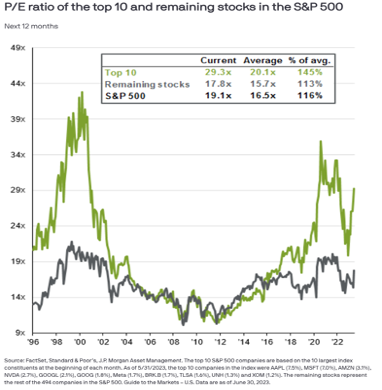

Similarly, given their massive price outperformance, the top 10 are now trading at a price to earnings multiple that is 145% of average while the remaining 490 are trading much closer to mean.

Meanwhile, the relative attractiveness of value stocks to growth stocks is quite extreme, with value screening quite inexpensively. Our message here is that we can find lots of attractive pockets within the market. We believe there is a substantial opportunity for the market to widen out and see participation from a broader set of names, sectors, and factors. We aim to take advantage of this dynamic.

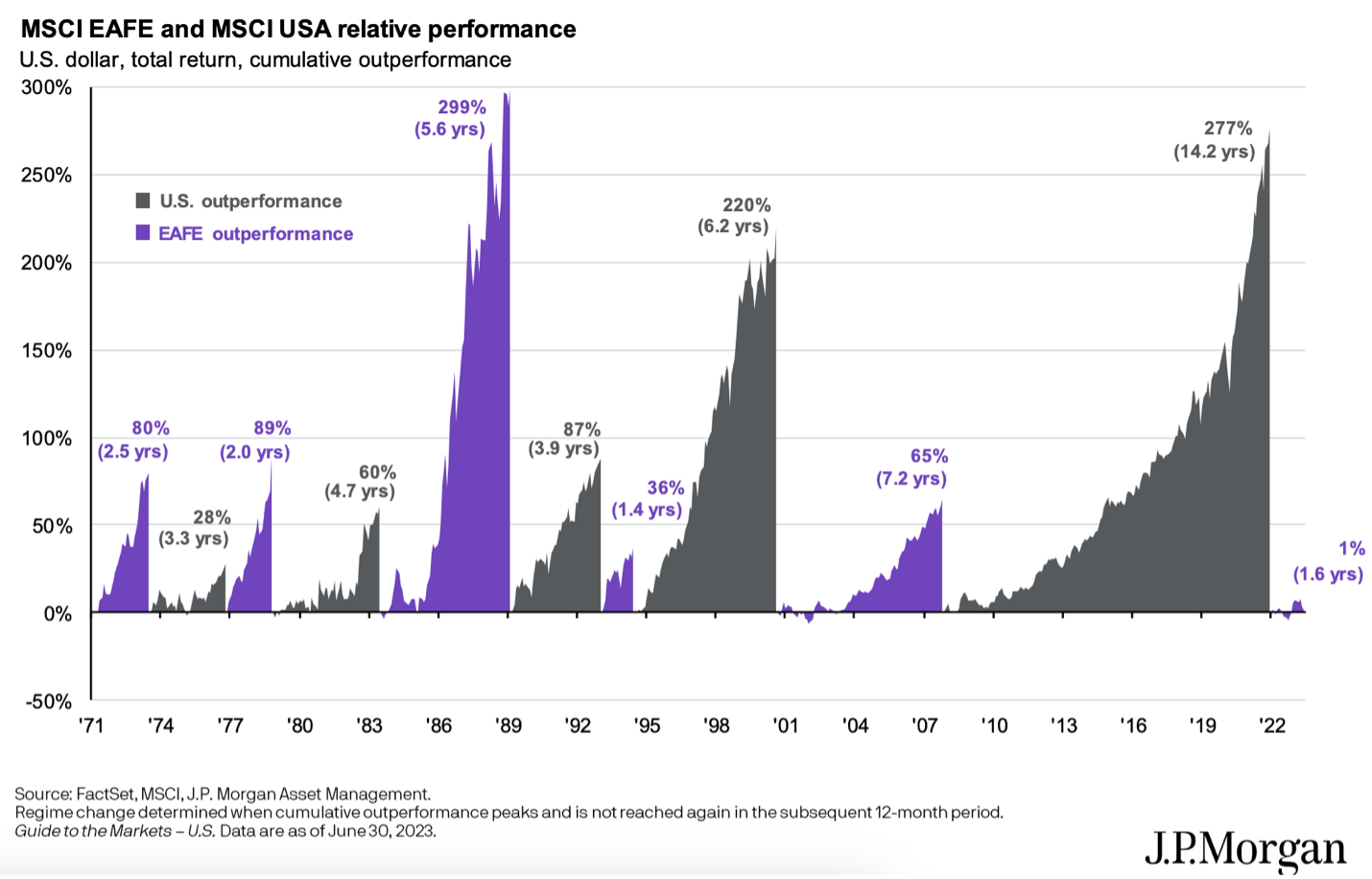

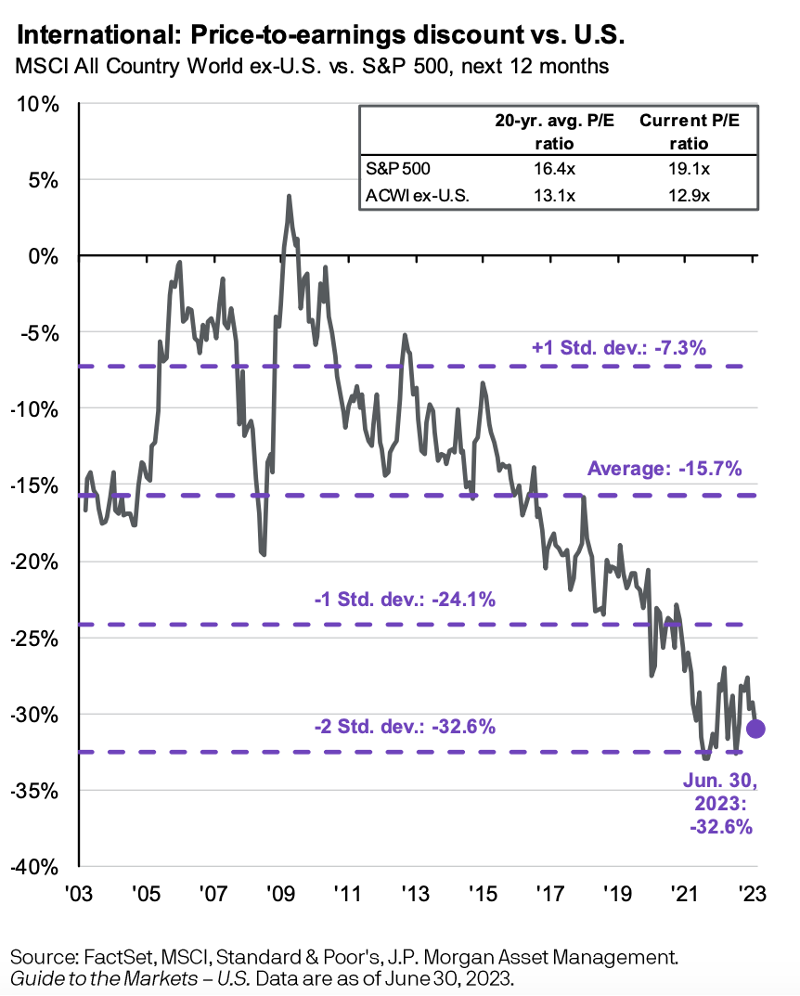

We also see an unbelievable opportunity for international and emerging markets to play catch up to the US. With the US having enjoyed a nearly 15-year period of outperformance, valuations have become quite appealing overseas, and ironically, corporate earnings internationally are outpacing our domestic growth. Said differently, you receive better earnings growth, higher dividend yields, and all the while enjoy valuations that are two standard deviations cheaper relative to historical averages.

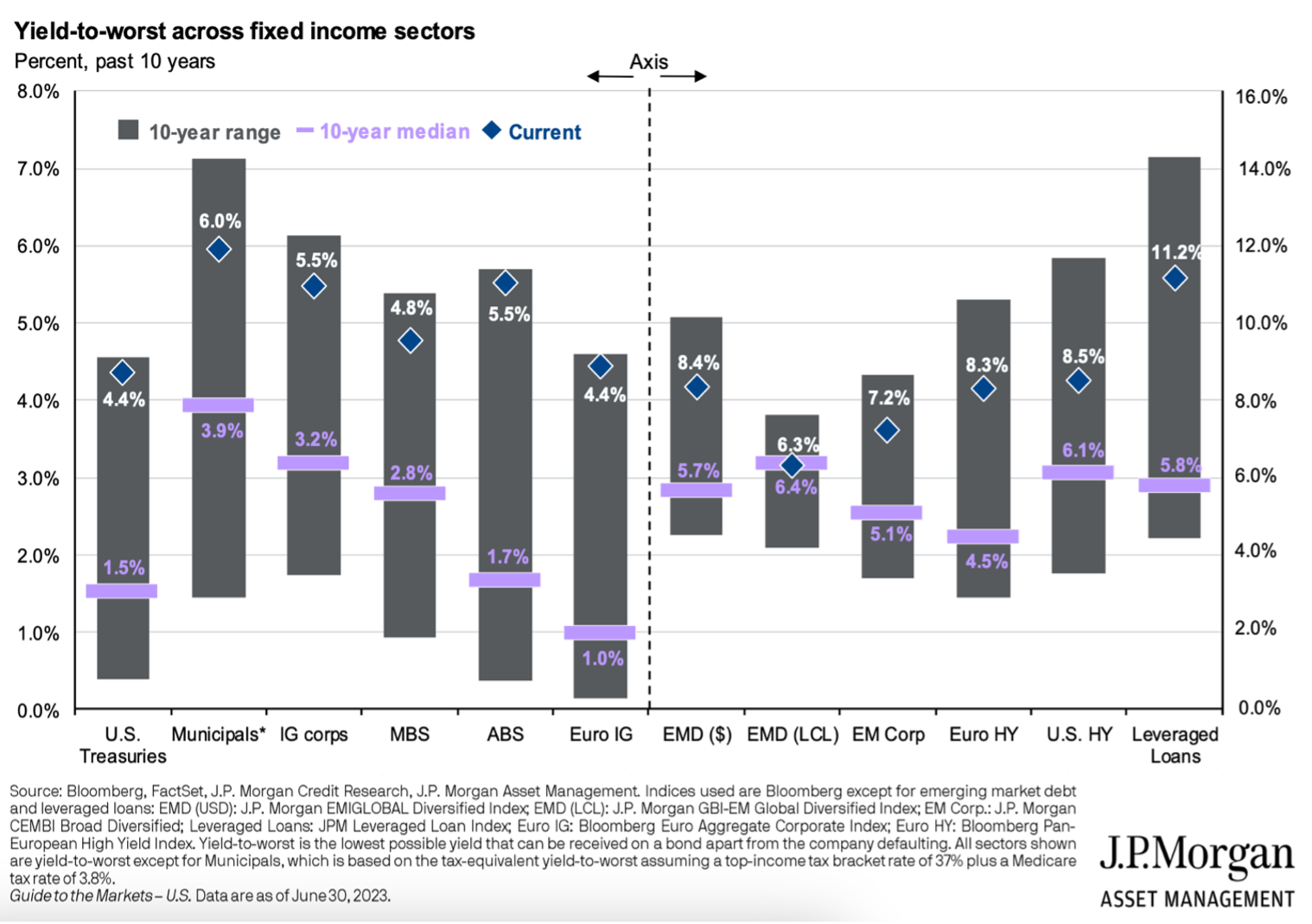

Finally, we remain convinced that the opportunity afforded in the fixed income market is compelling at present. If we are correct that the economy weakens and the Federal Reserve shift course, the greatest risk will be reinvestment risk. In that environment, traditional bonds will reward investors once again. We point out that 2022 represented the single worst fixed income return in history for the Barclays Aggregate Index (a broad measure of fixed income instruments). The illustration below shows how elevated rates are relative to historical averages of the past 10 years. If we see any type of mean reversion, fixed income instruments should see powerful rallies.

Wrapping this up, we at Westshore believe that the inflation war will be won. While economic conditions will deteriorate, any resulting slowdown and stock market volatility is an opportunity for deployment rather than a rush to the sidelines. We believe tremendous opportunities still exist to invest in domestic equities and fully expect market participation to broaden out at the sector, factor, and capitalization level. Furthermore, we are unabashed bulls on international and emerging market equities at this juncture. Finally, we expect interest rates to moderate over time, ushering in better fixed income performance.

We welcome your questions.

Important Disclosures

This commentary in this paper reflects the personal opinions, viewpoints and analyses of the Westshore Wealth employees providing such comments, and should not be regarded as a description of advisory services provided by Westshore Wealth or performance returns of any Westshore Wealth Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing herein constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Westshore Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.