Good chart on why this isn’t 2008 all over again

By Rob Sigler, MBA

March 20, 2023

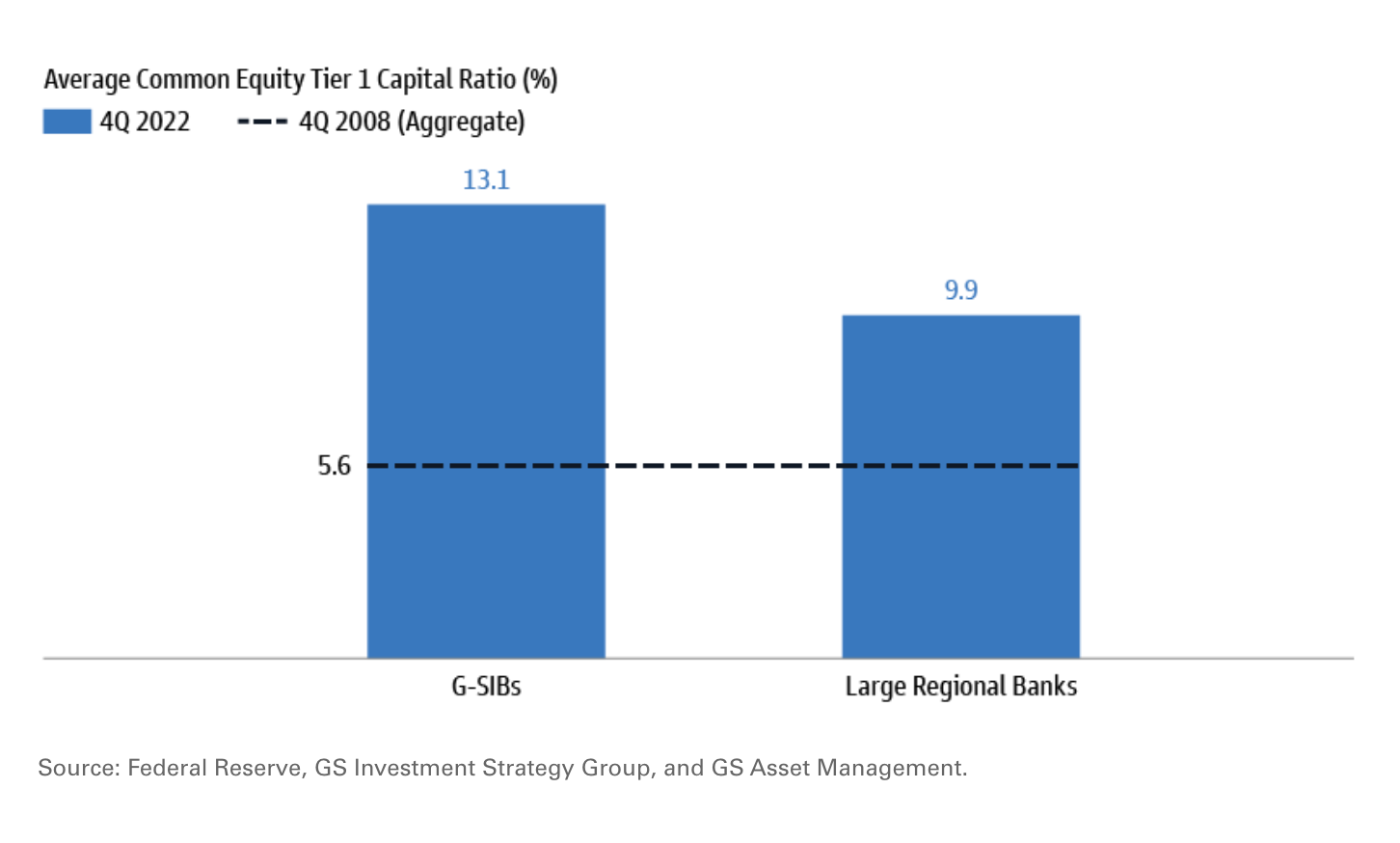

The banking system holds considerably fewer risky loans today than it did in 2008. As opposed to the credit crisis where 25% of all mortgages were floating rate and 5% of all loans were under water, today less than 5% of mortgages are adjustable today and less than 1% of loans are under water. In other words, the debtors were under enormous pressure during the credit crisis. Loans were growing increasingly delinquent and there was a high degree of bad debt expense. Additionally, banks had substantially less capital to absorb loses and service cash requests back in 2008. The problem was further compounded by the fact that many banks held a portion of their regulatory capital in mortgage back securities and those were decrementing in value aggressively. As you can see below, the banks enjoy much more healthy capital ratios this time around and don’t have the same pressure on their loan portfolio. Bottom line, we have a confidence problem today, as compared with 2008 when we had a true economic problem.