Estate Tax Exemption Sunset – Reemergence of the “Death Tax” for Many

By Lance Jamerson, CFP

July 1, 2024

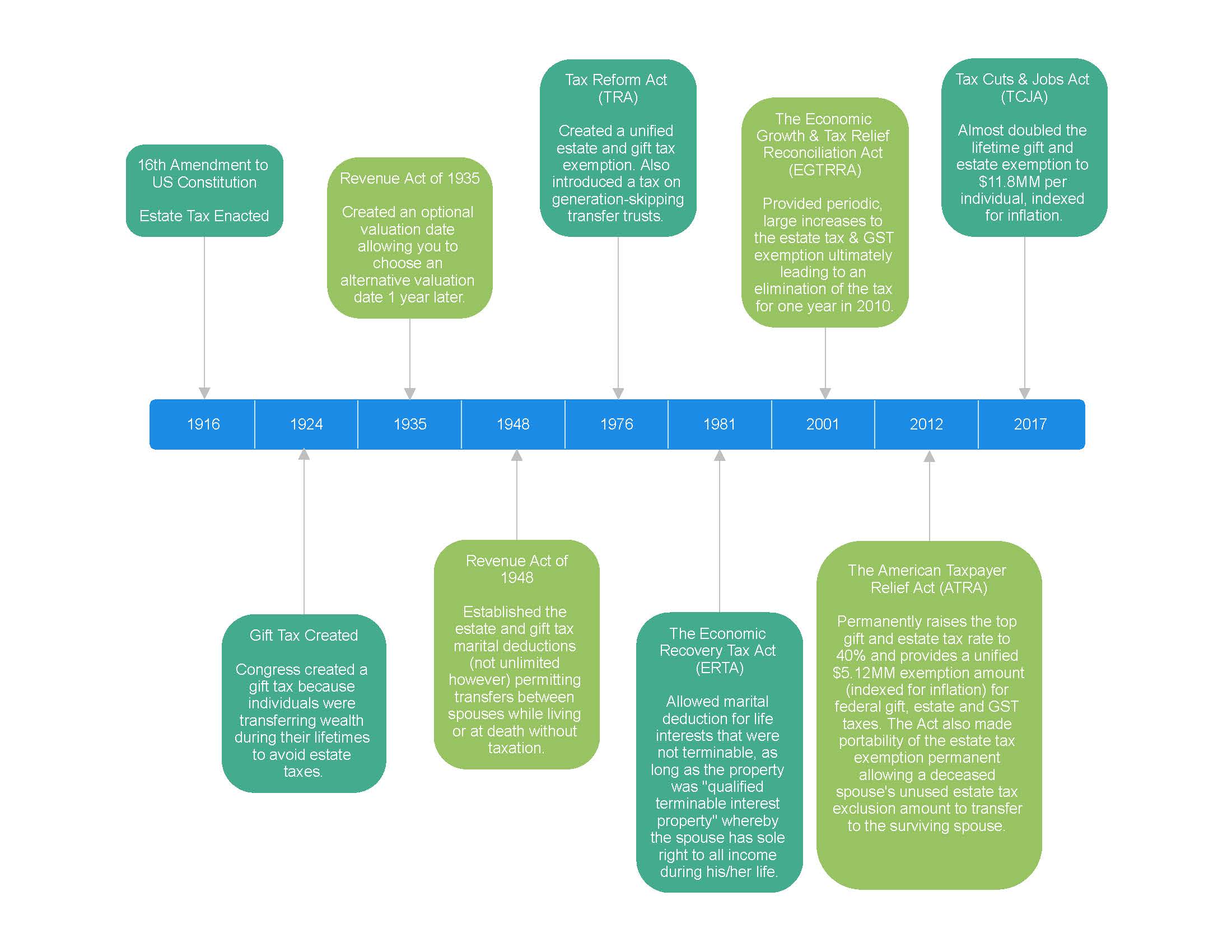

US estate taxes have been around a long time. There was the Stamp Tax of 1797 which required that federal stamps be purchased and used on wills and other estate documents during the probate process. It was created to raise funds for the Navy to defend the nation’s interest in response to an undeclared war with France and was repealed in 1802 when the crisis ended. The Revenue Act of 1862 created a federal death tax to help fund the Civil War and was repealed in 1870 after the war was over. The War Revenue Act of 1898 created a Federal legacy tax as a means to raise revenue for the Spanish-American War and was repealed once the war came to an end in 1902. With the US considering entering World War I, Congress passed the 16th Amendment to the US Constitution enacting the modern-day estate tax.

It seems that the estate tax was used as a way to raise revenue prior to or during a crisis. Since then, there have been many significant estate tax law changes as you’ll see below.

During President Trump’s first term in office, he passed the Tax Cuts and Jobs Act (TCJA) of 2017. This made the single largest increase to the estate, gift and GST tax exemption in the history of the United States. It raised the lifetime exemption from $5.6 million per person to $11.8 million per person, indexed for inflation. This year, the exemption amount is $13.61 million per person or $27.22 million per married couple. What does this mean? Well, if a single person’s estate isn’t larger than $11.8 million or a married couple’s estate isn’t larger than $27.22 million, then there are no estate taxes at death. If the estate is above those numbers, then you would pay 40% on every dollar above the exemption in the form of an estate tax to Uncle Sam.

What’s the Issue? Well, barring any changes to the tax law by Congress, the TCJA is set to sunset and expires December 31st, 2025. Historically, the estate tax exemption has been used as a bargaining chip and could be used again, so there is no telling where Congress may ultimately land. Assuming Congress can’t compromise prior to 2026, then the exemption will revert to the inflated version of $5.6 million per person. No one is exactly sure what the inflated version of $5.6 million is, but it’s expected to be between $6 and $7 million per person. To help understand how this may impact you, let’s use an example of a married couple that we’ll call Joe and Sally Jensen.

- The Jensen’s are currently retired and have a current estate value of $22,000,000 that includes the following:

- Personal Residence = $2,500,000

- Vacation Property = $1,200,000

- Real Estate Investments = $1,900,000

- Private Investments = $4,600,000

- Liquid Taxable Investments = $6,700,000

- Retirement Accounts = $3,600,000

- Life Insurance Death Benefits = $1,500,000

- The Jensen’s have utilized $650,000 of their lifetime exemption by giving $300,000 to their daughter for the down payment on a new home and $350,000 to their son to start a business.

Should I Consider Gifting Strategies Now? Since the estate and gift tax exemption are unified, you can use the exemption amounts to transfer assets either while you are living via gift exemption or at your death via estate exemption. If the current exemption is $13.61 million and it will move to $6 to $7 million in 2026, then there is a strong case to utilize the gifting exemption prior to the sunset. Using the example above, let’s look at a scenario where in addition to the $650,000 that The Jensen’s had already gifted, they gift an additional $19 million of their taxable estate. This would leave the Jensen’s with $3,000,000 in their estate rather than $22 million.

As you can see, by gifting the additional $19 million, it has no impact on the estate taxes in 2024 & 2025, but we were able to save $2,260,000 in estate taxes in 2026 assuming the sunset occurs. This provides The Jensen’s heirs and/or charities with $21,450,000 instead of $19,190,000 by taking advantage of the larger exemption that may go away in 2026.

Who Should Act? There are 3 categories of people that should be considering strategies prior to 2026 as follows:

- Married couples with a $11 to $14 million estate or individuals with a $5 to $7 million estate

If you fit into this category, you are currently well below the estate exemption and probably haven’t even considered any type of advanced estate planning because you haven’t been worried about having to pay estate taxes. However, in 2026, you will be very close to having a taxable estate and may have issues in future years if your estate is still growing at a significantly appreciable rate. If you fit in this category, you should at least consider speaking with your financial planner and an estate attorney to determine if your current estate plan will meet your needs after the sunset or if you should be consider making some adjustments.

- Married couples with a $14 to $27 million estate or individuals with a $7 to $13 million estate

If you fit into this category, you are currently below the estate exemption in 2024 and may not have considered any type of advanced estate planning because you haven’t been worried about having to pay estate taxes. However, in 2026, this changes if the tax laws sunset and you would immediately fall into the category of having a taxable estate. If you fit in this category, you need to consider strategies to reduce your taxable estate in the event the sunset occurs. We would strongly recommend you consult with your financial planner and an estate attorney.

- Married couples with an estate larger than $27 million or individuals with an estate larger than $13 million

If you fit into this category, your estate is currently exposed to estate taxes and the check you write to Uncle Sam will only get larger if the tax laws sunset. If you haven’t done any planning, you should meet with your financial planner and estate attorney. Even if you have done some existing planning to reduce your taxable estate; with the strong possibility of an estate tax sunset, you should meet with your financial planner and estate attorney to evaluate whether you need to employ additional strategies prior to 2026.

What strategies should I be considering? Every family’s financial situation is different, and everyone has differing goals and objectives. There are several strategies that we have employed with clients and their estate planning attorneys to alleviate estate taxes. This is by no means an exhaustive list of all the strategies that may work, but will provide some perspective:

- Outright gifting – Transfer stocks, income producing real estate, and other highly appreciable property to charities or family members who may be in lower tax brackets. This can help remove assets from your taxable estate and potentially reduce income taxes on an annual basis.

- Use One Spouse’s Gift Exclusion and Leave Other Spouse’s Intact – Families may wish to consider using the full $13.61 MM exemption of one spouse and leaving the other spouse’s intact. This would ensure that the family takes advantage of the higher exemption available today, while maintaining at least some level of exemption for the future.

- Spousal Lifetime Access Trusts (SLATs) – A SLAT is simply an intentionally defective grantor trust (IDGT) created by one spouse for the benefit of the other, along with any descendants. By including the spouse as a beneficiary, the grantor spouse is able to transfer assets outside of his/her estate, but still ensure that their spouse has access to those assets should he/she need it during his/her their life. The use of the word “intentionally defective” is confusing, but it simply refers to an irrevocable trust whereby the grantor pays the trust’s income tax bill during his or her life.

- Grantor Retained Annuity Trusts (GRATs) – A GRAT is a special type of irrevocable trust that allows the trustmaker/grantor to gift assets that are expected to appreciate in value to a trust and in return, the trust pays him/her a fixed dollar amount (annuity) each year for the term of the trust. At the end of the term of the GRAT, the trust terminates and the remaining assets will be distributed to the individuals or trusts you have named as remainder beneficiary. Because you may serve as Trustee, creation of a GRAT allows you to retain control and use of your property while transferring the property’s upside appreciation to the remainder beneficiaries tax-free. The term of the GRAT may be for life or any period of time, not less than two years, that you determine at the inception of the GRAT. If you die during the GRAT term, the GRAT assets will be included in your estate for federal estate tax purposes.

- Charitable Lead Trusts (CLTs) – CLTs operate for a set term, which could be the life of one or more individuals, and payments are made to one or more designated charitable beneficiaries for that time period. After the end of the trust term, the remainder of the trust is distributed to non-charitable beneficiaries—such as family members. It can potentially provide benefits such as an income tax deductions or estate or gift tax savings on assets ultimately passed to the individuals designated as remainder beneficiaries.

- Charitable Remainder Trusts (CRTs) – A CRT is an irrevocable trust that generates a potential income stream for you (the donor to the CRT) or other beneficiaries, with the remainder of the donated assets going to your favorite charity or charities. The CRT is a good option if you want an immediate charitable deduction, but also have a need for an income stream to yourself or another person. It is also a good option if you want to establish one by will to provide for heirs, with the remainder going to charities of your choosing. There are a variety of charitable giving vehicles from which to choose.

What’s Next? Since the potential sunset is fast approaching, we recommend looking at this sooner rather than later since estate planning attorneys will be in high demand as we get closer to the end of 2025. At Westshore Wealth, our goal is to listen to our clients’ needs and identify strategies that will help them achieve their objectives. There is no doubt that the current estate and gift tax exemptions create a unique window to do some advanced estate planning before the potential sunset on December 31, 2025. Since every client’s financial needs and desires are specific to them, it’s appropriate to review, discuss and explore the strategies that fit your specific needs. There are many challenges ahead, but as always, we are open to discussing any strategies with you to help improve your overall financial situation.