Chairman Powell Speaks on Inflation

By Rob Sigler, MBA

November 30, 2022

Federal Reserve Chairman Powell spoke at a widely anticipated event this morning. As expected, he signaled that the Fed will start to moderate the magnitude and pace of interest rate tightening which investors welcomed. However, he nonetheless remained steadfast that higher rates would be required to ultimately tackle inflation. As you know from our written work, we believe very few additional hikes will be required to slay the inflation beast. To that point, today represented a rich set of data points to support that view. First, ADP (the nation’s largest payroll processor) released their monthly National Employment Report which showed a sharp decline in job growth relative to expectations (127,000 vs 200,000 expected). This is the lowest monthly addition since January 2021. Second, the US Bureau of Labor Statistics released the job openings data, or JOLTS report as it is known. It witnessed a 353,000 reduction in job availability month over month and a sharp drop in the amount of workers who are quitting their jobs for other higher paying ones. It tells us that the competition for workers is slowing which is favorable for wage inflation longer term. Finally, the Chicago Purchasing Managers data was released. The index collapsed to 37.2 from an estimate of 47. For reference, any time the index is below 50, the economy is in contractionary mode. This is one region of the country, but nonetheless, it is a signal that Fed hikes are having a profound impact and we are still waiting for all the lags to play through the economy. When we couple these data with others that we are assembling, it indicates that inflation should start to see a meaningful reduction in early 2023. Take a look at the following illustrations.

Federal Reserve Chairman Powell spoke at a widely anticipated event this morning. As expected, he signaled that the Fed will start to moderate the magnitude and pace of interest rate tightening which investors welcomed. However, he nonetheless remained steadfast that higher rates would be required to ultimately tackle inflation. As you know from our written work, we believe very few additional hikes will be required to slay the inflation beast. To that point, today represented a rich set of data points to support that view. First, ADP (the nation’s largest payroll processor) released their monthly National Employment Report which showed a sharp decline in job growth relative to expectations (127,000 vs 200,000 expected). This is the lowest monthly addition since January 2021. Second, the US Bureau of Labor Statistics released the job openings data, or JOLTS report as it is known. It witnessed a 353,000 reduction in job availability month over month and a sharp drop in the amount of workers who are quitting their jobs for other higher paying ones. It tells us that the competition for workers is slowing which is favorable for wage inflation longer term. Finally, the Chicago Purchasing Managers data was released. The index collapsed to 37.2 from an estimate of 47. For reference, any time the index is below 50, the economy is in contractionary mode. This is one region of the country, but nonetheless, it is a signal that Fed hikes are having a profound impact and we are still waiting for all the lags to play through the economy. When we couple these data with others that we are assembling, it indicates that inflation should start to see a meaningful reduction in early 2023. Take a look at the following illustrations.

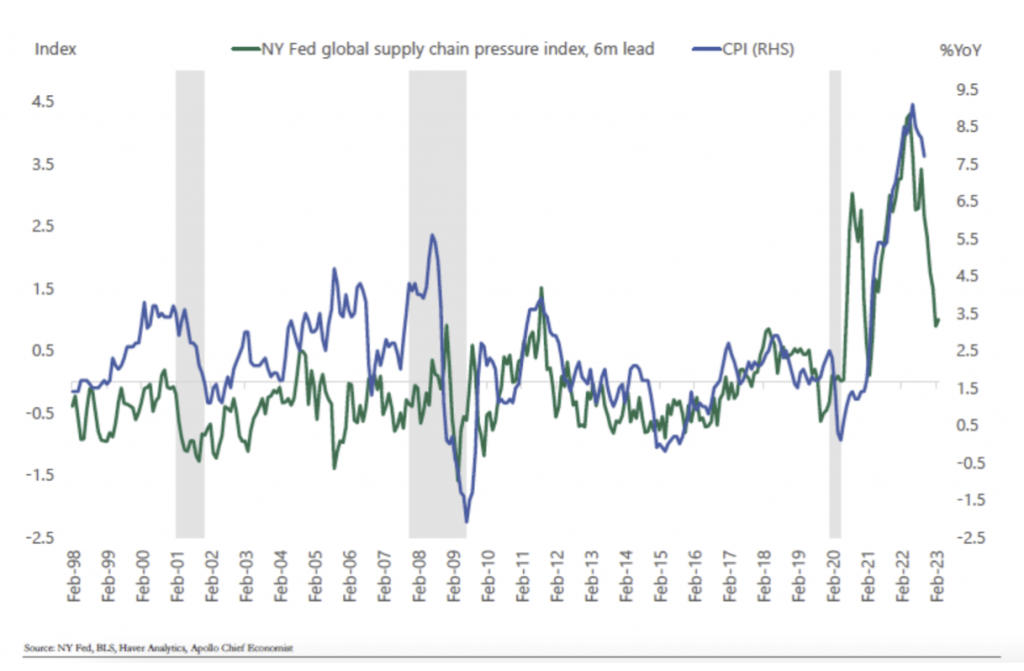

As seen below, supply chains are normalizing rapidly. Traditionally, CPI has followed this by roughly 6 months.

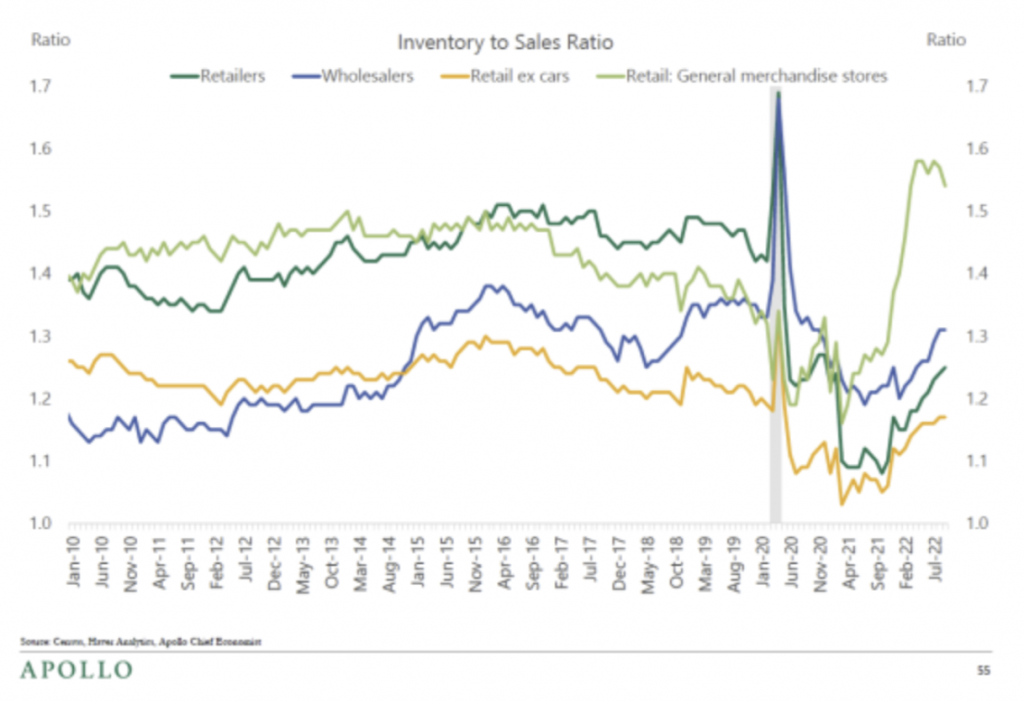

Second, inventories have normalized for many industries. For general merchandisers, they are actually looking rather bloated. If the economy slows, retailers will have to start marking down inventory to move product.

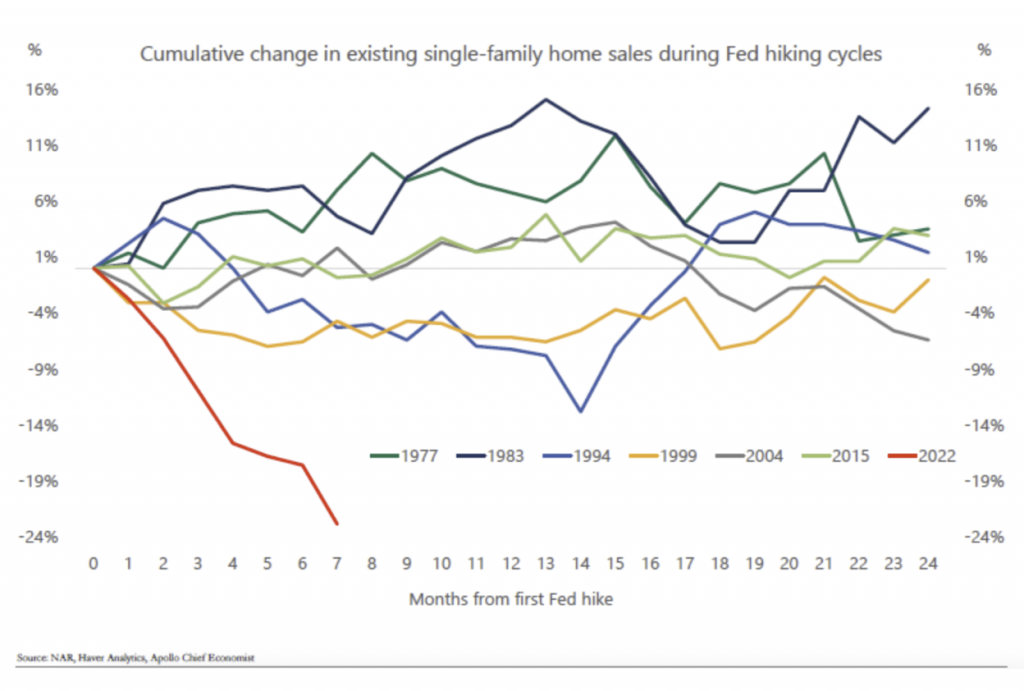

Third, existing home sales are slowing down at a very abrupt rate for what is ordinary in a Fed tightening cycle. This should translate into more pressure on the shelter inflation category.

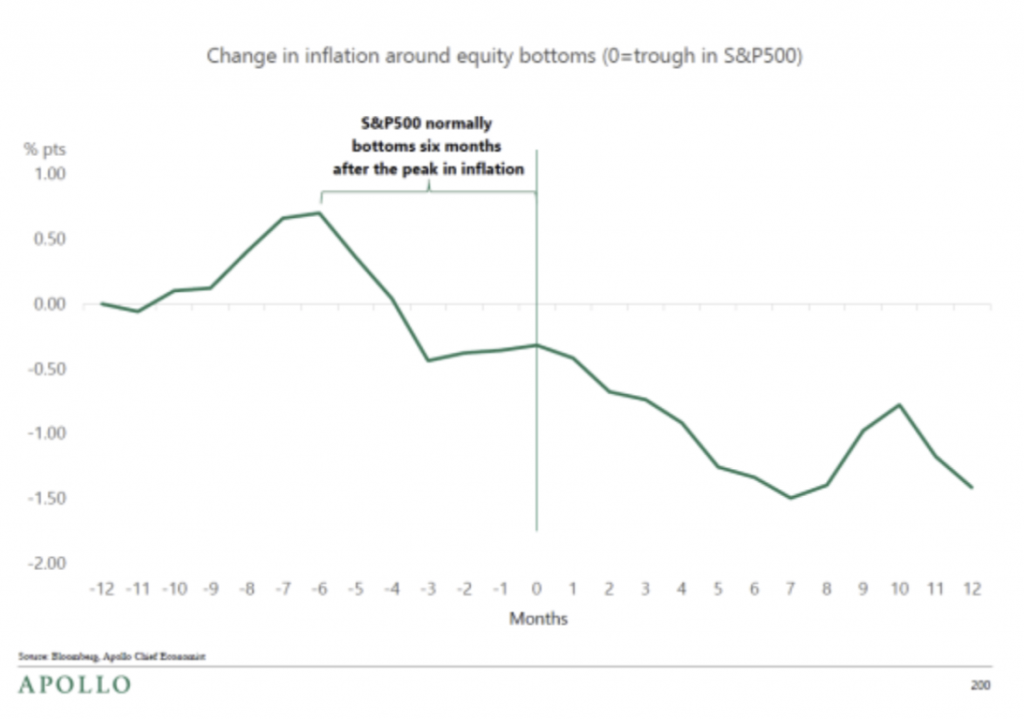

Why is all this important? Inflation peaked back in June and has been decelerating since. Traditionally, the equity market bottoms six months after the peak in inflation which triangulates to December 2022. If we start to see demonstrable signs that inflation is decelerating more meaningfully, it should allow the Federal Reserve to conclude their tightening cycle. Historically, equity market participants start to focus on recovery at that point and begin to look past bad economic news. Time will tell, but the signals are moving in the right direction.