Don’t Fall Prey to Recency Bias

By Rob Sigler, MBA

May 14, 2024

Human beings are prone to put excess focus on the most recent events or facts, while underweighting historical precedent and reversion to the mean when it comes to investing. This cognitive bias is called recency bias. We hear it frequently when investors question why we would want to invest in international or emerging markets. They point to the fact that the US has significantly outperformed all other indices for many years and that investing outside of the US is simply wasted time.

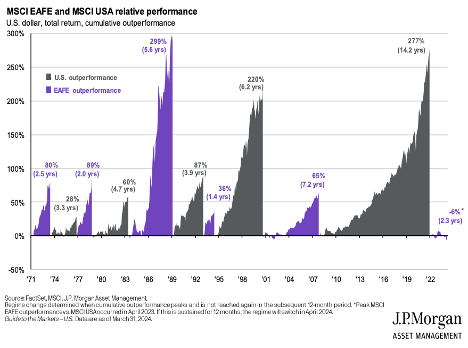

As you can see from the following illustration, clearly the US has enjoyed a massive amount of outperformance relative to broader international markets. Cumulatively, the US has outperformed international markets by 277% in the last 14.

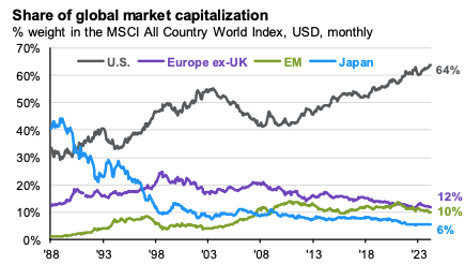

As a result of this outperformance, the total size of the United States stock market has risen to 64% of total equity capitalization worldwide. This is an extreme figure.

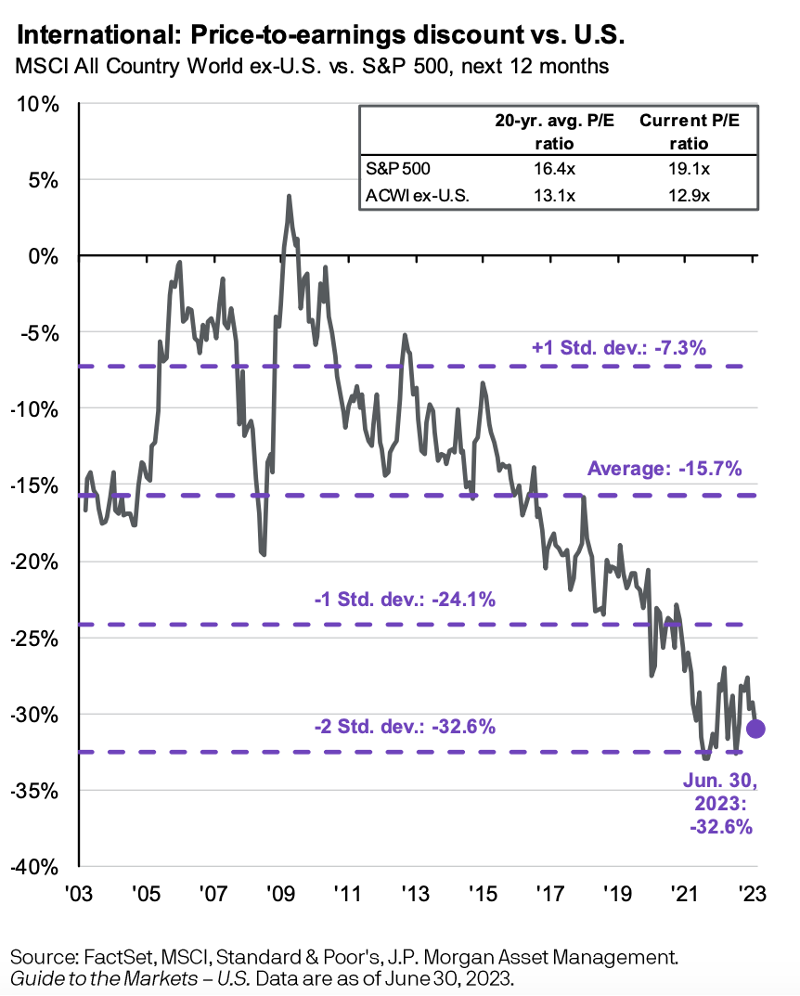

Meanwhile, international valuations look extremely attractive. In statistical terms, international markets are now two standard deviations cheap relative to the US. What does that mean in English? Essentially, the valuation gap between international and US markets is larger than it has been in 95% of all observed data points. Again, this is extreme. That said, what is the catalyst for a reversal in trend? We believe it will be a switch from tightening monetary policy to monetary accommodation. We anticipate that will occur in Fall 2024. In fact, we are already started to see some interest rate easing in international and emerging markets (China, Mexico, Switzerland). While we haven’t pulled the trigger to overweight these markets, we anticipate doing so before year end and wanted to prepare our clients for that circumstance.