It’s Difficult to Drive while Staring at the Rear View Mirror

By Rob Sigler, MBA

October 11, 2023

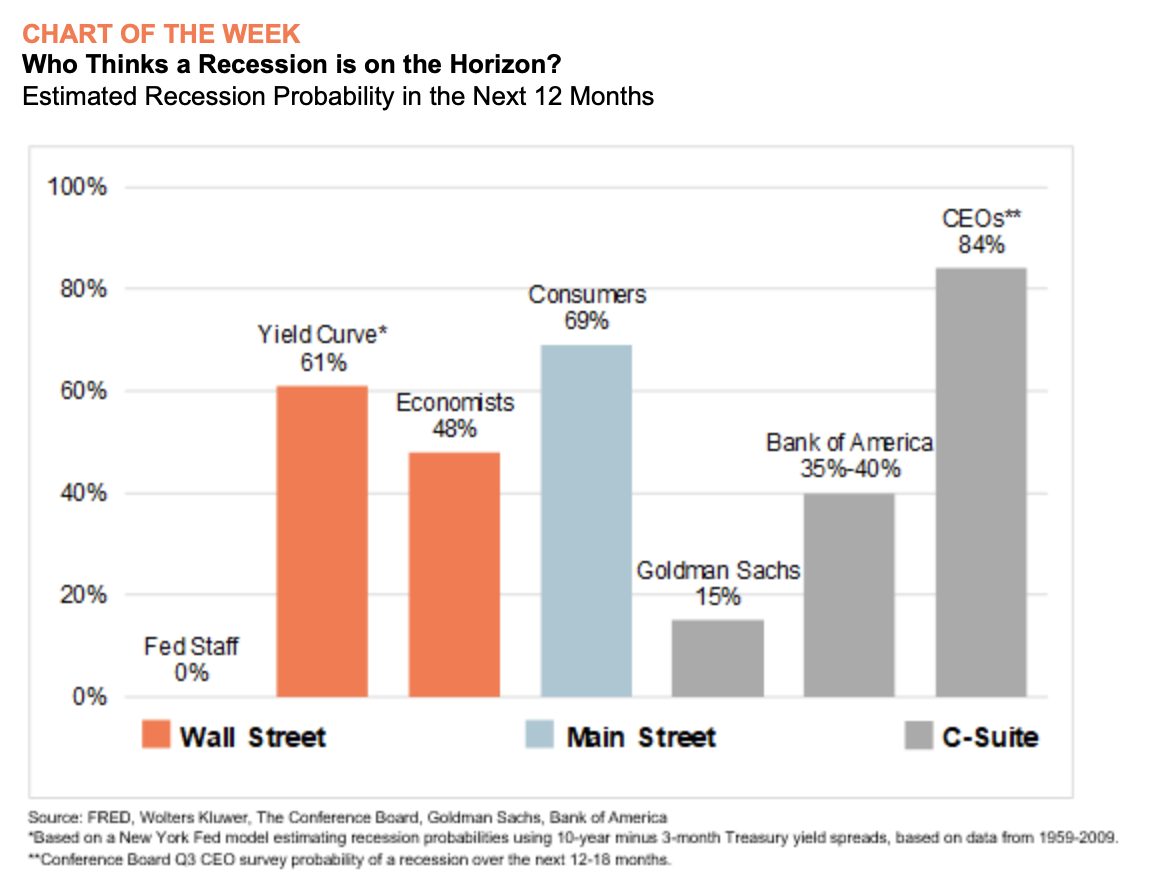

The following illustration is one of the most head-scratching that I have seen in some time. It shows the probability of recession by various prognosticators. 84% of corporate CEOs, 69% of consumers, and strangely, 0% of Federal Reserve Staff project recession in the next 12 months. I continue to think the Fed is busy watching lagging indicators, while the leading indicators are screaming that a slowdown is right ahead of us. This is the largest increase in Fed Funds rates in over 40 years. The reaction function by which interest rates affect the economy hasn’t changed. It appears to have been delayed by the excess savings accumulated during the pandemic, but that has now run its course.

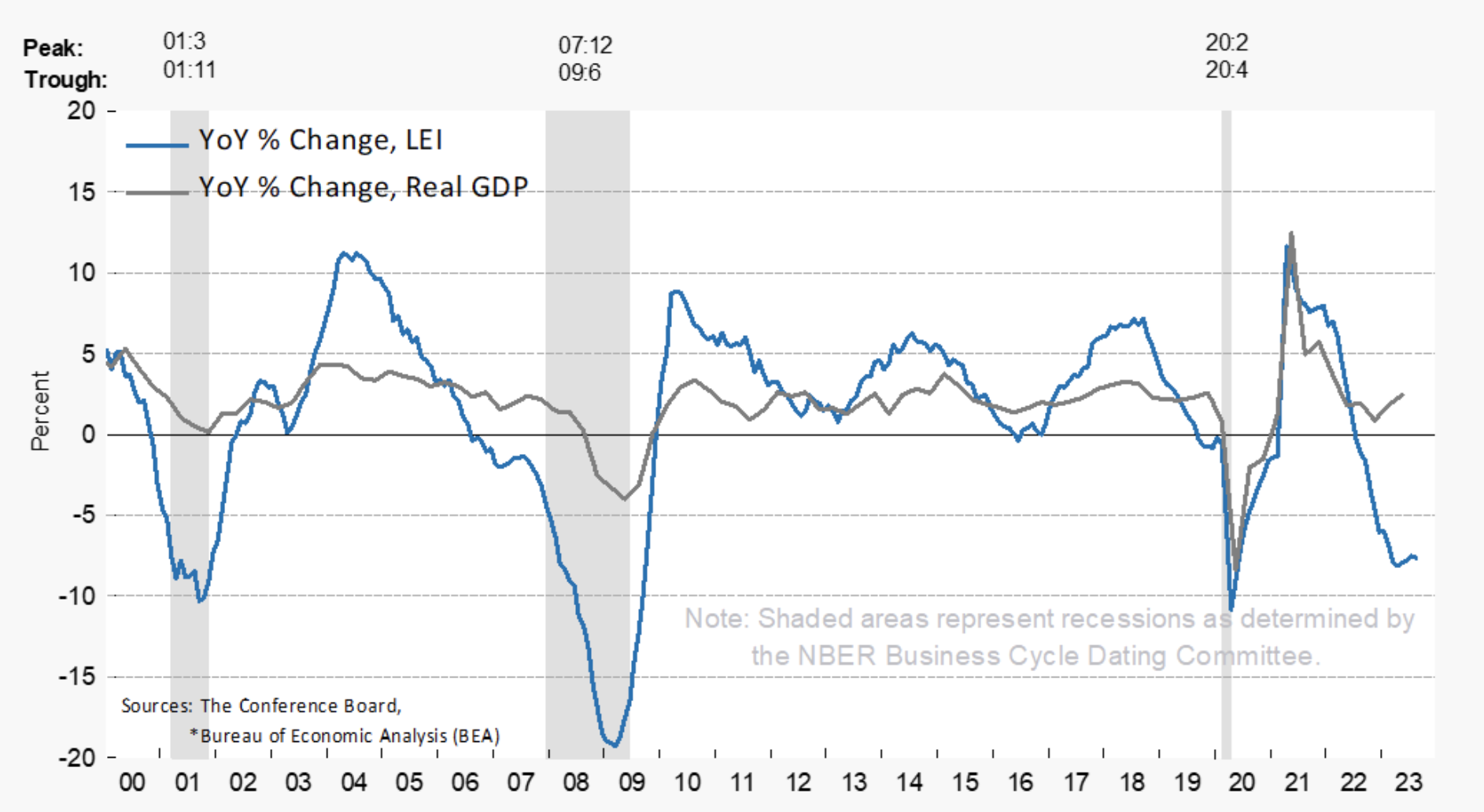

So let’s examine, how the transmission effects typically take place. They start to have an impact on credit sensitive areas of the economy. Home sales sputter (check box). Auto sales cool (has been obscured by the lack of inventory on the market and now a strike, so it is still not obvious). High ticket durables start to languish (sales of electronics, appliances and furniture have all fallen sharply, check box). Minimum credit card payments accelerate (check box). Delinquencies of consumer credit start to show up (auto, credit card, and buy-now, pay-later are getting crushed. Check box). Savings rates dip as consumer dip into reserves to fund rising debt payments (they have fallen from 8% to 4%, check box). Corporate bankruptcies start to accelerate (check box). Banks tighten lending standards (check box). Companies react by cooling capital expenditures (check box). The last link in the chain is consumers start to slow their discretionary purchases of consumer services and that forces companies to react by reducing headcount. We aren’t at that final stage yet, but all the precursors that lead up to that event are in place. As I said, the Fed is watching the wrong part of the reaction function. The second chart, blue line, is the US Leading Indicators as published by The Conference Board. Over the past 20 years, when the US Leading Indicators has dipped this low, recession has followed.

Unfortunately, the Fed has a very poor track record of catching turns in the economy. Much as they were caught completely flat-footed as obvious inflationary signs became abundant in 2021, I think that they are once again missing some obvious signals this time around. We wrote a piece back in August 2021, entitled “It’s Never Different This Time,” begging for the Fed to realize the impending inflation threat. It’s simple the inverse today. Regrettably, the Fed can’t stop staring in the rear view mirror. Our sense at Westshore, is that the economy will cool down. This will ultimately cause the Fed to reverse course. As they do, Treasury Bonds, which have woefully underperformed for the past two years, will start to sail. As such, you will soon see that we have added exposure to this investment category within our client accounts. Let us know if you have any questions.