Market Concentration – NVDA

By Rob Sigler, MBA

June 12, 2024

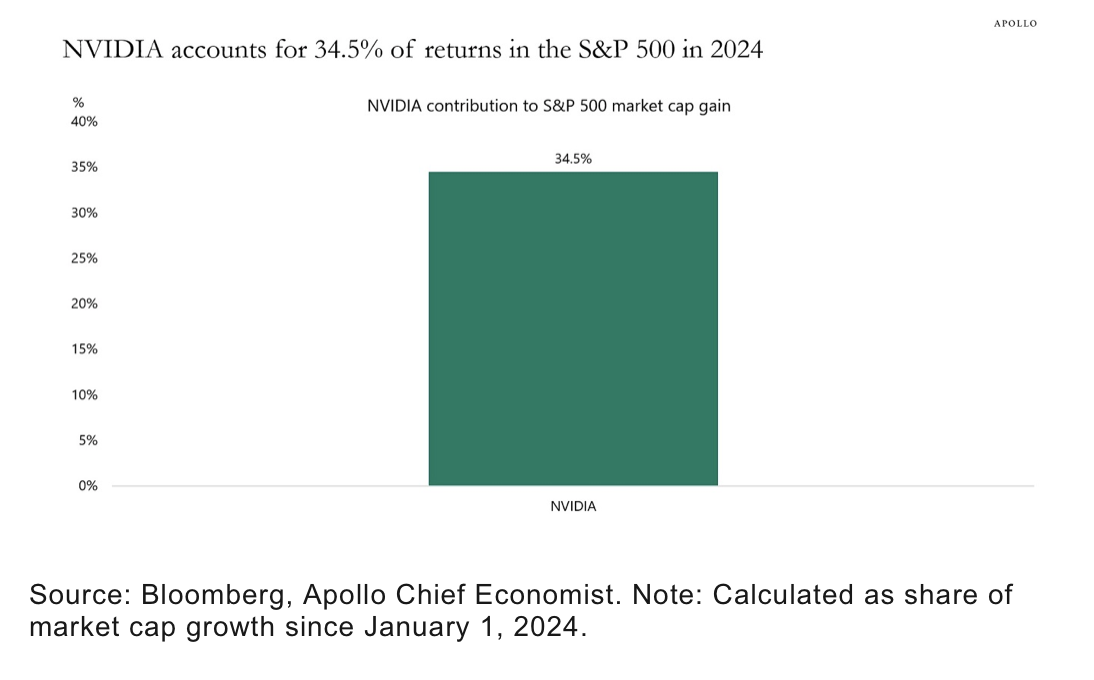

Nvidia is now responsible for over 1/3rd of the 2024 year-to-date S&P 500 return. In my experience, the single most powerful trades occur when investors see a very visible, and highly touted theme, and have very few avenues to express the bet. Investors tend to crowd into that name irrespective of valuation. Generally, it doesn’t work out how they expect. That is exactly the situation for Artificial Intelligence (AI) today. We continue to believe that AI will likely be an evolutionary trade. Much like the advent of the internet over 20 years ago, the biggest companies to benefit from AI may either be in their infancy today or not even invented yet. For those that think I’m crazy, let’s stroll down the internet-age memory lane. AOL was the shiny toy as individuals discovered the World Wide Web. With precious few ways to express the bet, it rose to amazing heights. It is now an obscure footnote, left in the dust by Google and Microsoft. Do you even remember AltaVista? It was the first search engine. Google conquered them quickly. Remember the first major social network? How many identified MySpace? Facebook, now Meta, extinguished that flame. Before Netflix conquered video streaming, how many people remember the granddaddy that invented the entire streaming concept? Anyone still have a Napster account? No. They are defunct. How about Pets.com, Webvan, or eToys.com? They are all gone, destroyed by Amazon.

My point is not to bash Nvidia. I happen to love the company. They have been around for a long time and morphed their products from gaming to automobile cockpit visualization solutions, to autonomous driving, supercomputing, and now AI. I think they will be highly viable for years to come. However, I want you to understand where we are in the AI journey. Right now, every company is exploring how to analyze their data and reach conclusions more efficiently. To do this, they need huge computing power. NVDA’s chips sit at the epicenter of where we are in the race to deploy AI. You can’t create intelligence without processing power. However, the next phase of AI will be figuring out how to use generative AI to replace workers, streamline workflow, and reduce cost. That will take a lot of time and be much more evolutionary. There is going to be a baton shift at some point from building raw horsepower to figuring out how to use the horsepower. I’m not sure how long that will take, but when it happens, it could be an awkward moment for Nvidia. I would draw your attention to a different industry. Back in 1998, Craig Venter, founded Celera to sequence the human genome. The promise was individualized medicine with treatment modalities that hadn’t even been explored. Three years later he accomplished the mission. Celera went public and rose to $276 at its peak. It was going to lead to a healthcare revolution. Fast forward, it nearly went out of business, selling itself to Quest Diagnostics years later for $8. What happened? A company by the name of Illumina came along with a genetic sequencing machine that allowed sequencing times to compress dramatically. What took three years, now takes less than 1 hour. Meanwhile the cost to decode the genome has fallen from $150,000 to $200 in the last 14 years.

Illumina, however offers some lessons for the current AI boom. Much like Nvidia, it commanded, and frankly continues to command, the leading edge technology. Their revolutionary solution has propelled science in unimaginable ways. However, genome sequencing reached a point where raw horsepower took a back seat to figuring out how to use the horsepower. Sequencing a genome in 30 minutes versus an hour might not justify the expense of buying the latest machine. The older machine will do. The real money is being made by pharmaceutical companies like Merck that harness the power of the genome to design medications that can target certain proteins or energize other immune responses. Illumina’s stock offers pause to those that believe that valuation is irrelevant, peaking back in 2021 at over $550. It resides at $111 today. This is a stark reminder that the fear of missing out can severely compromise your forward returns. We continue to recommend that individuals stick to diversified investing as the way to compound returns over the long haul as opposed to chasing the shiny new toy.