The Phoenix

By Rob Sigler, MBA

September 13, 2023

The Phoenix

As Mark Twain famously said, “the reports of my death have been greatly exaggerated.” I can’t help but feel like the bond market is in that situation today. 2022 marked the single worst year in US bond history with the Barclays U.S. Aggregate Bond Index down -13.02%. That has been followed by an anemic, 0.72% positive year-to-date performance in 2023. Investors have largely given up on these securities, moving to money markets, short-term U.S. Treasuries, and CDs with their capital preservation sleeve. We think that is the wrong move. In a nutshell, we believe the Federal Reserve’s tightening campaign has run its course, the economy and inflation will slow further, and 4Q23 could have some triggering events that could cause a flight to safety that sees investors embrace bonds once again.

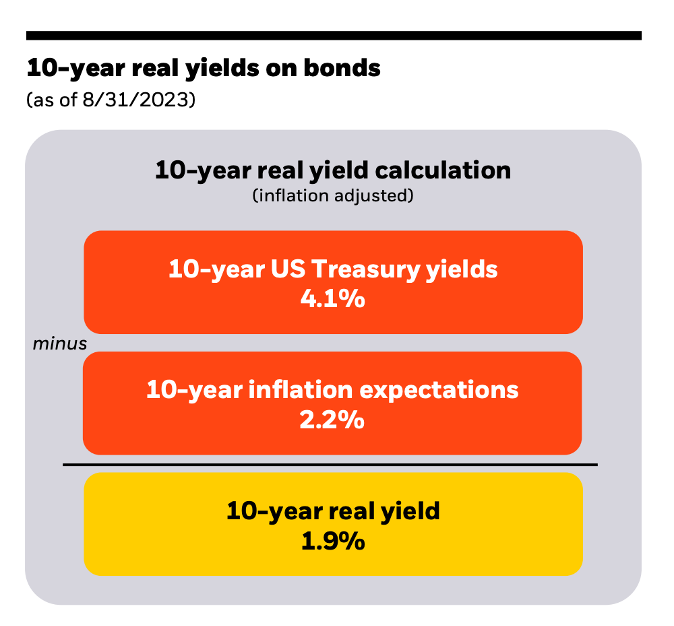

On the first point, we firmly believe that the Federal Reserve will hold rates steady during its September 20th meeting. Since the last Federal Open Market Committee (FOMC) meeting, numerous Federal Reserve board members have remarked that they favor holding policy at the current rate to assess whether it is sufficiently restrictive. We think that makes good sense as U.S. Treasury yields now substantially exceed inflation expectations. This is what is known as the real yield on bonds.

Source: Morningstar, Federal Reserve, Bureau of Labor Statistics

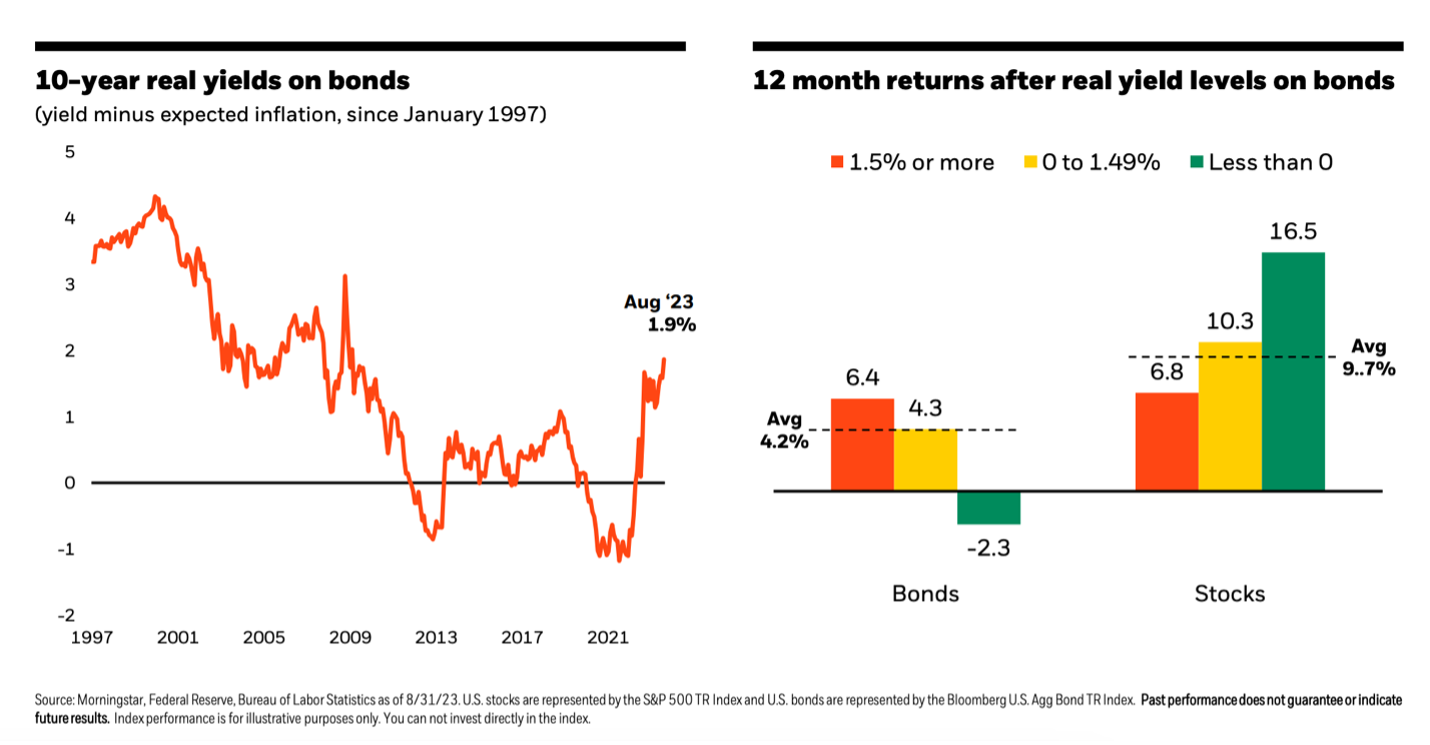

Why is that important? Better bond performance has been associated higher real yields. As the illustration shows below, when real yields average 1.5% or more, the twelve-month subsequent returns for bonds have average 6.4%.

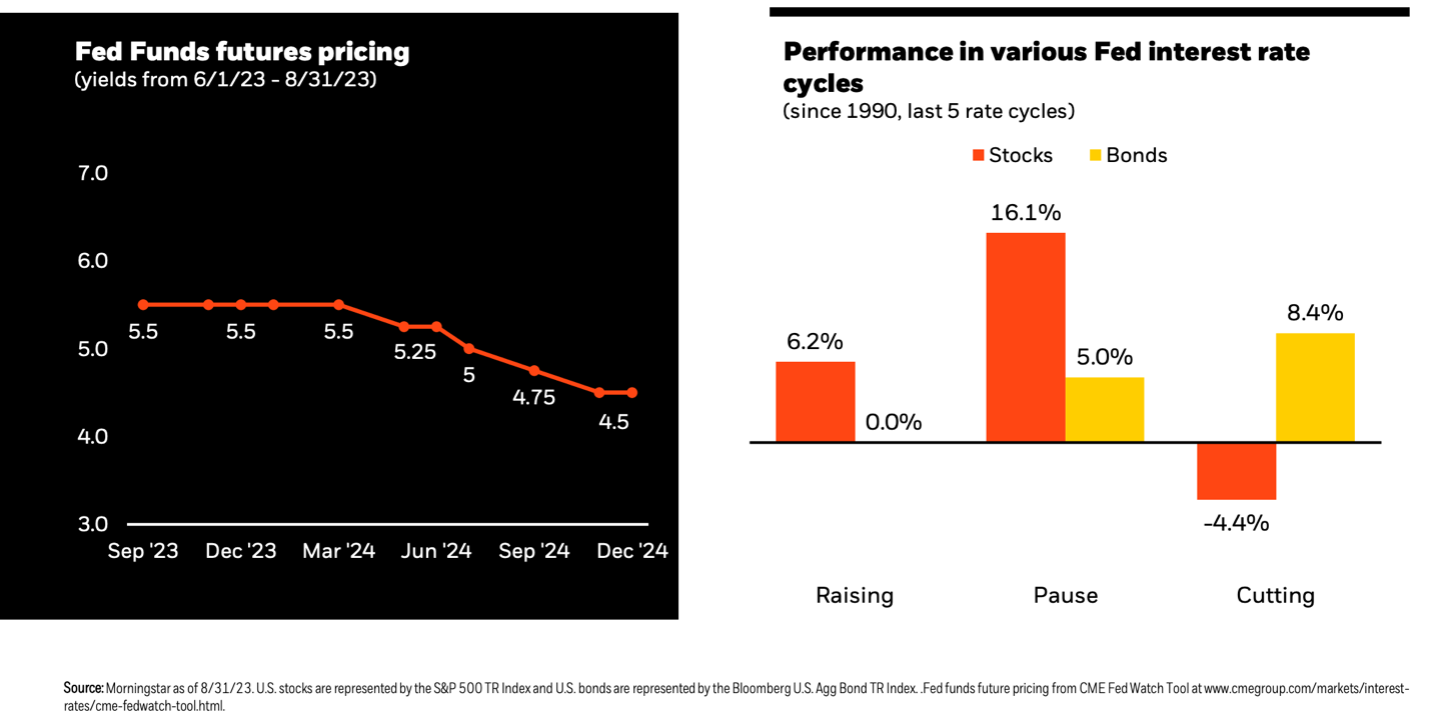

And by the way, our opinion doesn’t sit uncomfortably out on a limb. It is broadly consensus that the Federal Reserve will enter into a pause period with rates. Fed Funds Futures (a broadly traded futures index that bets on the direction of interest rates) predicts rates will remain paused at the 5.5% mark for the next nine months. If true, that should be good news for bonds. In the past five Federal Reserve tightening cycles, upon reaching the pause phase for rates, bonds subsequently started to rally.

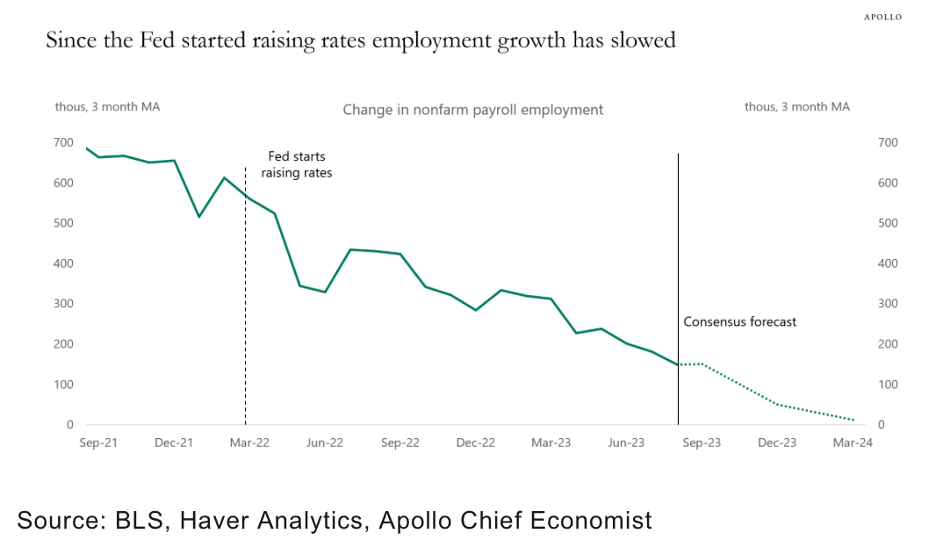

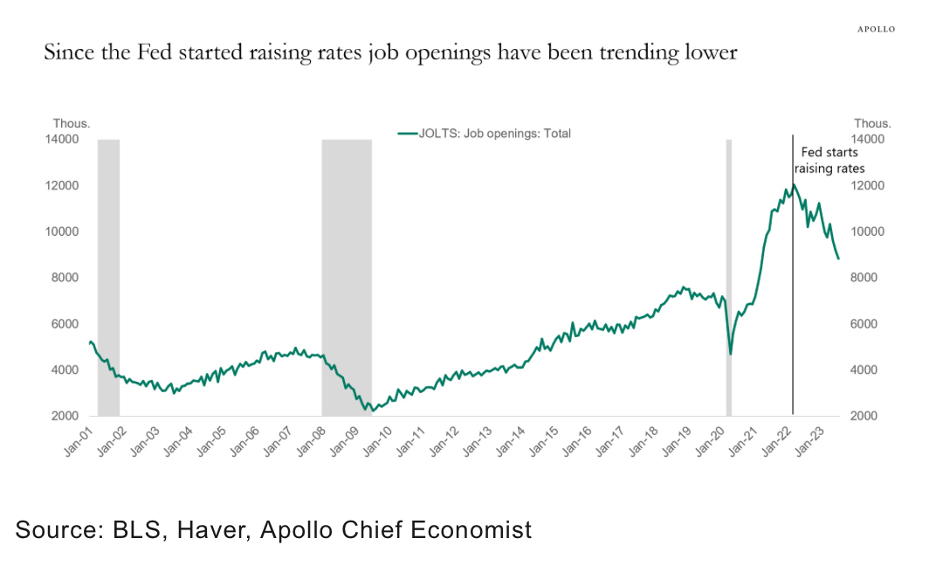

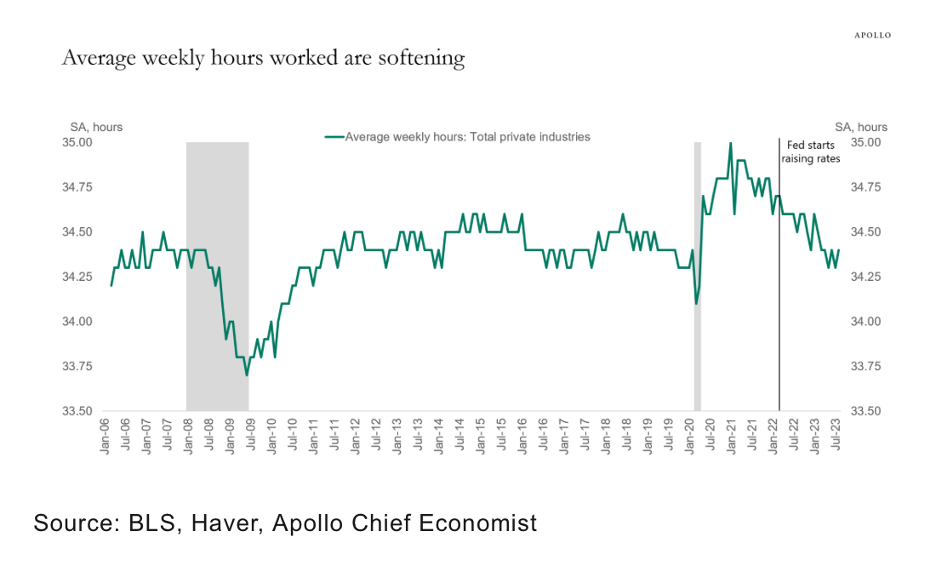

Here is where we differ from consensus thinking. We believe the employment and economic growth will continue to slow. Specifically, since the Federal Reserve began raising rates, non-farm payrolls have started to decrement lower, job openings have been shrinking, and average weekly hours worked have been softening. Our sense is that an object in motion tends to remain in motion. If the Federal Reserve keeps rates at these elevated levels for another nine months, it is unlikely that these trend lines suddenly start to move sideways. They are apt to continue to their trend.

Furthermore, we believe investors are failing to input three exogenous risks into their calculation for economic growth. First, student loan payments are set to resume in October 2023 for the bulk of outstanding borrowers. That subtracts an annualized $70bn from disposable personal income. That could cost the economy almost a half point of growth. Second, there is a very material risk of a Federal Government shutdown. Funding runs out September 30th, 2023 for the US Government. Twelve separate appropriation bills need to be passed by both chambers of Congress to avert shutdown. Alternatively, the House and Senate could agree on what is referred to as a Continuing Resolution (CR) that extends FY23 funding at current levels. Our sense is that some short-term shutdown is likely before a CR is eventually passed. Every week that the government is shut costs the economy roughly 0.2% to quarterly growth. Finally, while there appears to be progress of late, one cannot rule out an automotive strike if the UAW and the Big 3 auto makers fail to produce an agreement. Contracts are set to expire this Thursday, September 14th at midnight. Each week of lost production would cost the economy about 0.1%. While two of these triggers are transitory in nature, they nonetheless are real risks to economic growth that could cause more weakness that is presently modeled. Our sense is that could be a positive development for fixed income instruments and it could accelerate when the Federal Reserve feels comfortable starting to reverse course on its tightening campaign.

Let us know if you have any questions.