The Pivot, The Divot, and The Spigot

By Rob Sigler, MBA

December 28, 2023

Executive Summary

Capital Markets — We see three stages of performance in 2024.

- The Pivot—The pivot signifies the period when investors realize that the Fed has concluded rate hikes and begins the watch for when they will begin to ease. The pivot is already in motion. It began in September 2023 when the Federal Reserve initially paused its tightening campaign and continues today. During pivots, we see a rapid repricing of equities and fixed income alike as investors come out of their defensive crouch.

- The Divot—During this phase, investors will start to realize the shift in Fed policy is an acknowledgement that economic conditions are weakening. Initially weaker data is welcome, but as it turns too cold, investors start to worry about the increasing probability of recession and the negative impacts to corporate earnings from slowing growth. We expect this to be a period of volatility for equities and lower quality bonds, while a positive for US Treasury securities.

- The Spigot—Finally, when it becomes abundantly clear that tight financial conditions and high interest rates are negatively impacting consumer spending, capital expenditure, and leading to higher unemployment, we expect the Federal Reserve to initiate a campaign of easing interest rates. This will open the spigot, so to speak, for future economic growth. As investors begin to focus on the impending recovery, a broad equity and bond rally should ensue.

Economy — Much like our thoughts above, there will be transitions along the way in 2024.

- Inflation will continue to recede towards the Federal Reserve’s target of 2% as lags in housing data catch up and energy prices continue to moderate.

- Economic growth will continue to slow, consumer spending will falter, and unemployment claims will pick up.

- As the economy hits stall speed, the Federal Reserve will likely shift to an easing interest rate policy stance. Given our starting place of very full employment, recession is likely avoided.

- As interest rates fall, credit conditions will ease, and the seeds of recovery will be planted. Credit sensitive spending categories and business capital expenditure will start to display green shoots.

Investing — We think 2024 will offer several opportunities to make tactical trades.

- In the capital preservation bucket, we believe it will be a very favorable year for high quality Treasury, Municipal, and Corporate bonds. Lower quality loans and bonds should be avoided in the first half of 2024, but will likely see recovery in the second as interest rates ease. We will be looking for that inflection to transition our bets.

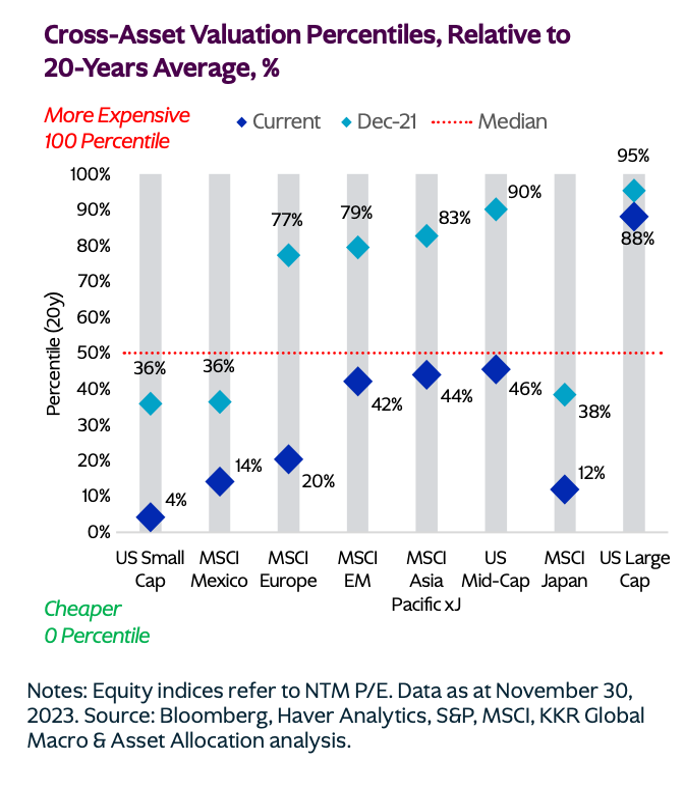

- When the baton passes to an easing interest rate cycle, we believe there will be dramatic broadening out within the equity market. Small and mid-size capitalization stocks, high dividend payors, value securities, as well as international and emerging markets should see outsized moves relative to large cap technology and growth equities that have been the hiding place for the past 12 months. We will adjust our weightings in the growth bucket to accommodate that view as the divot phase concludes.

- In alternatives, we believe difficulty securing affordable credit for strapped corporate borrowers and deteriorating economic conditions will yield a profound bankruptcy cycle. This is an incredible opportunity to play restructured credit. As such, we have increased our weighting to distressed debt recently. We also believe the private equity space is replete with opportunity, as cash starved businesses are ripe for takeover at very attractive multiples. We have already populated that sleeve for many of our clients.

- In real assets, we anticipate a dramatic recovery in public real estate equities, or REITS, as interest rates ease. Most of these equities are trading at dramatic discounts to net asset value, but lack a catalyst at present to break out of their doldrums. The shift in interest rate policy is likely that catalyst.

As we look forward to 2024, we think market performance will be broken into three distinct phases, something we refer to as the pivot, the divot, and the spigot. The pivot is what we refer to as the inflection point in Federal Reserve monetary policy. The pivot officially began in September 2023 when the Fed first paused its tightening campaign, signaling that they had made progress toward achieving their goal of normalizing inflation. Only recently have investors embraced this fact and started to rearrange investment chess pieces accordingly. Our sense is that the pivot will unfortunately yield to the divot. As is always the case, the lags in monetary policy transmission (the time between the rate hikes and when we see it in the economic data) are long. Our sense is the economic softness that we are just starting to witness will not conveniently arrest itself quickly. It will continue to get softer. At some point, investors who have latched onto the view that the United States economy will encounter a soft landing (meaning slowing growth, but avoidance of recession) will have that view tested. At that juncture, we could encounter some volatility. However, when it becomes abundantly clear that tight financial conditions and high interest rates are negatively impacting consumer spending, capital expenditure, and are leading to higher unemployment, we expect the Federal Reserve to initiate a campaign of easing interest rates. This will open the spigot, so to speak, for future economic growth. As investors begin to focus on the impending recovery, a broad equity and bond rally should ensue.

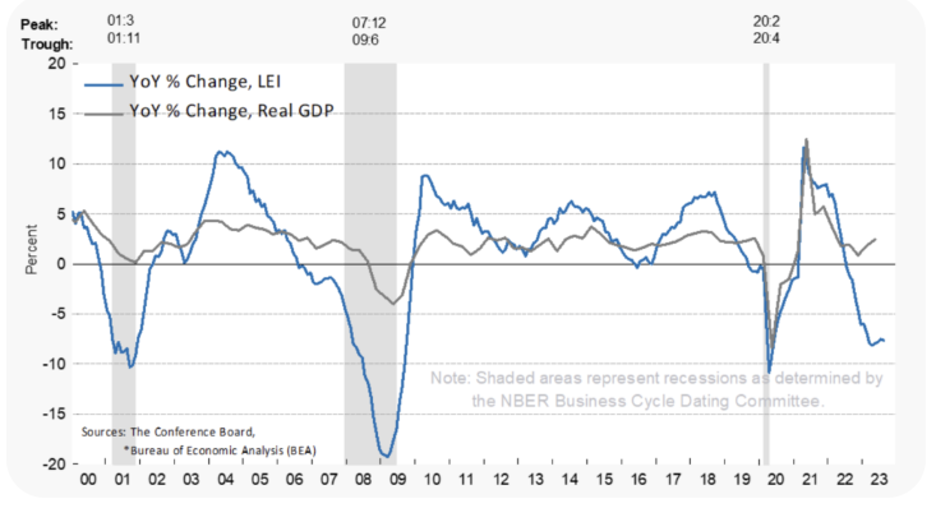

While we thought the pivot was rather obvious to spot, it was surprisingly controversial. Leading economic indicators were crashing and inflation continued to recede.

As we opined in our September 2023 piece, entitled The Phoenix, we strongly believed “the Federal Reserve’s tightening campaign [had] run its course.” Fortunately, we used that dissonance of investor views to initiate substantial positions in long duration Treasury Bonds in mid-October, an allocation shift that produced favorable rewards.

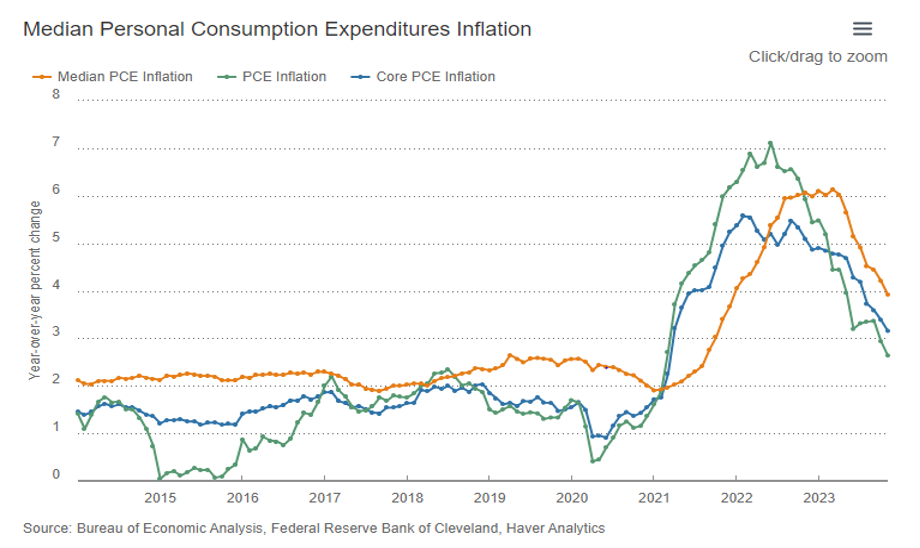

Fast forward to present, the pivot has been fully embraced by investors as the Fed’s preferred inflation measure, the Personal Consumption Expenditures index, is fast approaching their 2% target.

Not only has this allowed the Fed to hold rates steady during its November and December meetings, it has permitted them to signal that an easing of monetary policy lies ahead in 2024. The impact on markets has been profound. Prior to 4Q23, the equity rally was concentrated in a very narrow group of technology companies that were assumed winners of the artificial intelligence theme. The bulk of equities were flat to down on the year. Meanwhile, Treasury, municipal, and corporate bonds were all negative on the year heading into 4Q23. However, the realization that rates could be trending lower propelled a scorching equity rally that broadened substantially to include heretofore neglected stocks and sectors. Bonds followed suit with an equally powerful ascent. We think this is a preview for what is the come in 2024, however, we believe there might be a gut check first.

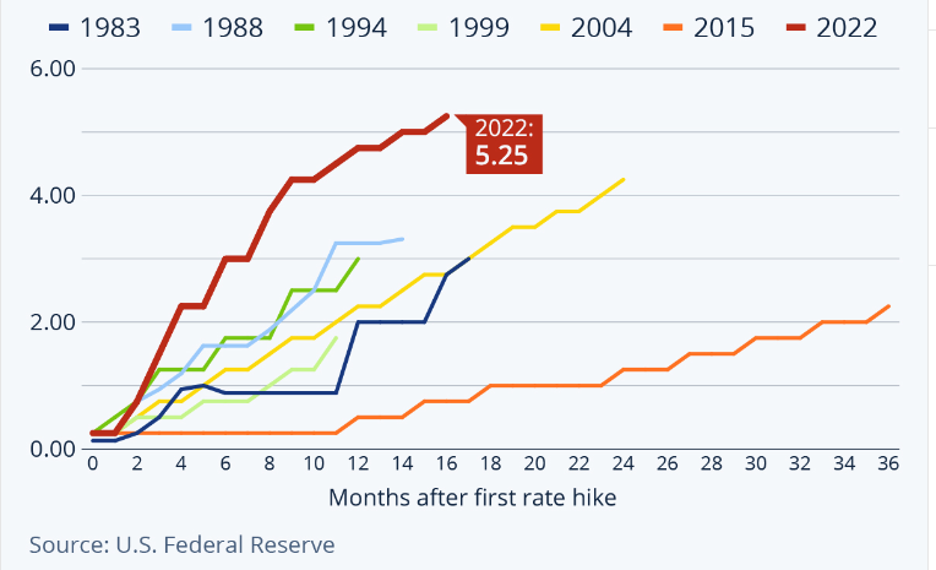

The divot is apt to arrive sometime in 1H24. At present, investors believe the Fed will orchestrate a harmonious slowdown of inflation while not pressuring the economy into stall speed, or recession. The divot is a realization that unfortunately, economic conditions tend to follow Newton’s First Law of Motion. Namely, an object in motion stays in motion. Translated to the financial world, the Federal Reserve just concluded a tightening campaign where they raised rates by 525 basis points (5 ¼ percentage points) over roughly 18 months. That is the largest increase in rates in over 40 years.

The transmission mechanism of higher interest rates to the economy takes time, but the consequences are always the same. Interest sensitive consumer categories like housing, autos, and consumer durables (appliances, electronics, furniture) are the first to see demand decrease. That has occurred. Second, consumers and businesses alike start to feel the impact as revolving credit slowly reprices. Interest payments go up as a result. Having less disposable income, consumers react by slowing their discretionary purchases. Retail sales show this emerging trend. Next, credit delinquencies start to rise. We see this in credit card receivables and the auto finance market presently. We also see this in Ch. 11 business bankruptcy filings which have doubled in the past 12 months. Additionally, businesses react by slowing capital expenditure. Again, this is visible in the data. Finally, in reaction to weakening demand, employers start to jettison employees. To date, that trend has been admittedly modest. While job creation has slowed, and the gap in job openings, relative to job seekers, has narrowed, thus far we have not seen a demonstrable uptick in unemployment claims. It is this last datapoint that we are watching carefully. If we can navigate this period without any major hiccup in employment, the Fed will be able to deliver the fabled soft landing and avoid something worse. Our bet is that we will land somewhere in between. Our starting point on employment is favorable, as is the fact that the growth in new working-age employees in 2024 is expected to be modest. Our sense is that the economy will inevitably drift towards stall speed, but that recession can be averted.

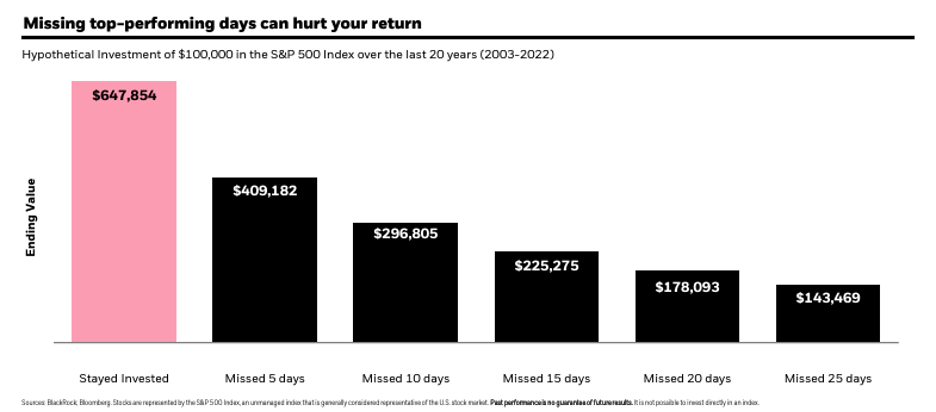

However, before that occurs, we expect growing anxiety on the part of investors. As conditions weaken, corporate earnings will likely disappoint and valuation will potentially recede for equities. Rising delinquencies will imperil high yield bonds, leverage loans, and direct lending instruments. By contrast, US Treasuries, as well as high quality municipal and corporate bonds should be bastions of safety. Perhaps counterintuitively, we think the divot will be of short duration. Why? As soon as the data becomes evident, the impetus for the Federal Reserve to shift to an easing stance will grow stronger and push their hand. As such, we caution investors against trying to market time this episode. We think the danger of missing out on the transition to the spigot phase is too great.

As my former hedge fund client Marty Zweig famously said, “don’t fight the Fed.” Once the Federal Reserve realizes that monetary policy is too tight and is responsible for arresting economic conditions too harshly, they will powerfully shift gears and open the monetary spigot. As they lower rates, all the negative trends that we outlined in the divot will start to work in reverse. The vicious circle will be transformed to a virtuous one. Despite the fact that corporate earnings performance will still be getting worse, investors will look past the dip and focus on the recovery. Many of the out of favor investor categories like small and mid-capitalization stocks, high dividend payors, value securities, international and emerging market equities will rally. It is imperative that we as investors and managers not miss this phase. It will be powerful.

Our investment outlook for 2024 at Westshore is the following. In the capital preservation bucket, we believe it will be a very favorable year for high quality Treasury, Municipal, and Corporate bonds. Lower quality loans and bonds should be avoided in the first half of 2024, but will likely see recovery in the second as interest rates ease. We will be looking for that inflection to transition our bets. When the baton passes to an easing interest rate cycle, we believe there will be dramatic broadening out within the equity market. Small and mid-size capitalization stocks, high dividend payors, value securities, as well as international and emerging markets are exceedingly cheap compared to historical averages and should see outsized moves relative to large cap technology and growth equities that have been the hiding place for the past 12 months.

We will adjust our weightings in the growth bucket to accommodate that view as the divot phase concludes. In alternatives, we believe difficulty securing affordable credit for strapped corporate borrowers, coupled together with deteriorating economic conditions will yield a profound bankruptcy cycle. This represents an incredible opportunity to play restructured credit. As such, we increased our weighting to distressed debt recently. We also believe the private equity space is replete with opportunity, as cash starved businesses are ripe for takeover at very attractive multiples. We have already populated that sleeve for many of our clients. Finally, in real assets, we anticipate a dramatic recovery in public real estate equities, or REITS, as interest rates ease. Most of these equities are trading at dramatic discounts to net asset value, but lack a catalyst at present to break out of their doldrums. The shift in interest rate policy is likely that catalyst.

Please let us know if you have any questions.