Why we must fight the urge to be bearish

By Rob Sigler, MBA

May 10, 2023

The most frequently asked question by our clients recently is why with the litany of bad news on the horizon (possible US Treasury default, potential US recession, ongoing concerns about the health of the banking system, persistent inflationary pressures, China/US tensions, etc.) aren’t you turning more bearish, especially given the context that you keep arguing that the Federal Reserve has already increased rates too aggressively. With that in mind, I assembled four quick charts that attempt to tell the story. However, before I do that, let me refresh you on our view of the world in quick bullets…

- We believe that inflation is receding quickly and will dramatically surprise to the downside as lagged housing data in the CPI calculation catches up to real time measures and we begin to anniversary the base effects of the inflation peak in June/July.

- With that in mind, we believe the Federal Reserve has already applied too much monetary tightening and will be forced to lower rates by Fall 2023.

- Adding insult to injury, the Fed seems to be ignoring their own data that shows a dramatic reduction in lending by small/mid-size regional banks post the failures of SVB, Signature and First Republic. Given that regional banks are responsible for 30% of all lending in the United States, and the fact that they tend to lend to small enterprises who employ the bulk of Americans (54% of Americans are employed by firms with less than 500 employees), it seems rather obvious to us that credit starved small enterprises could respond to difficult financial conditions by laying off employees.

- As such, we think the odds of a some form economic contraction is likely. That said, we think it will prove quite shallow given that we are a fully employed economy and the fact that consumer balance sheets are in great relative shape. We also believe recession is largely factored into investors calculus by now with a record 60% of professional forecasters projection an imminent contraction.

Again, so why aren’t we more bearish?

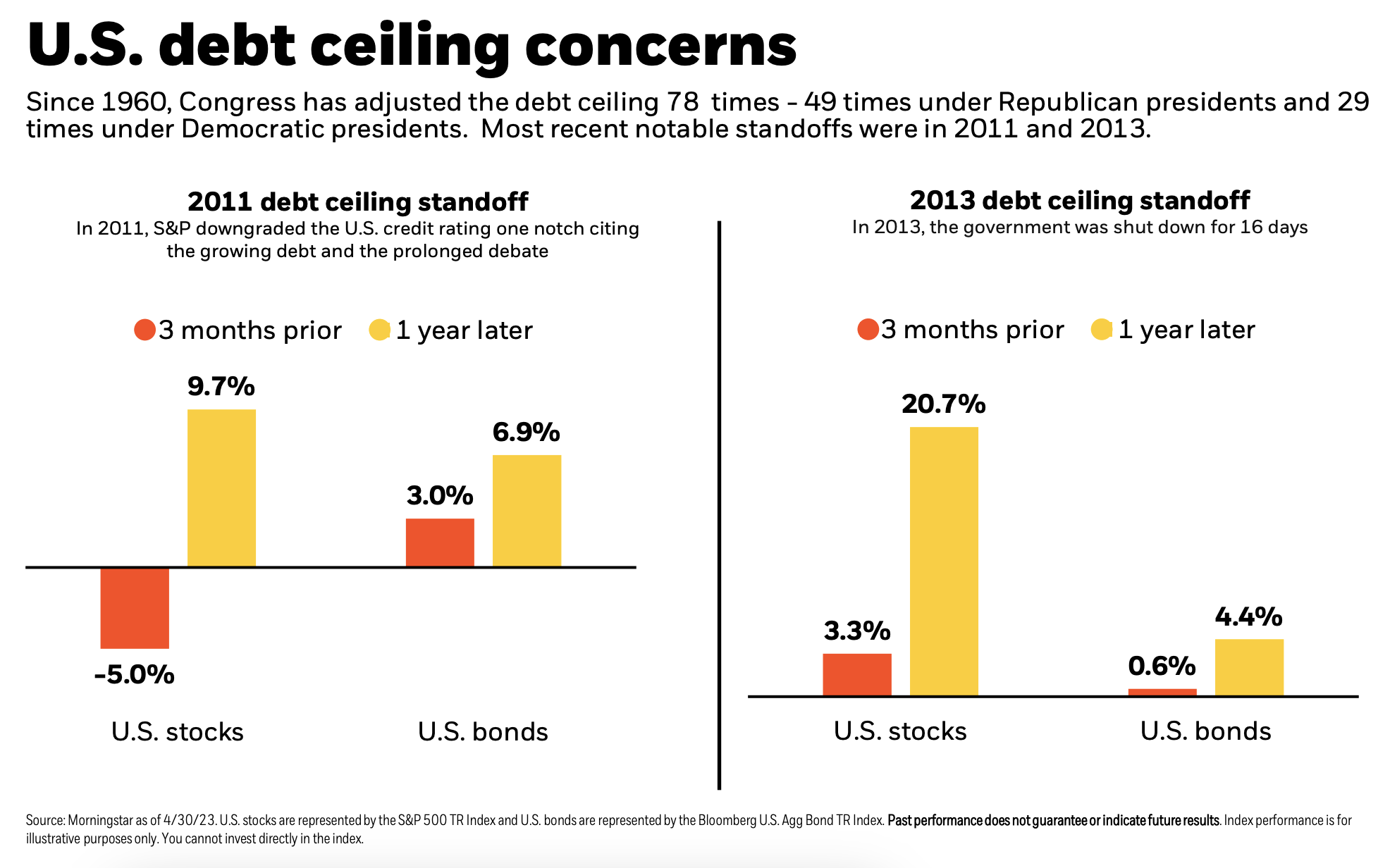

Let’s tackle the risk of a debt default by the USA first. It seems to be the most pressing concern voiced by our clients. Our view is that the risk is vastly overstated. Despite our extremely divided government leadership, the participants in Congress and in the Oval Office understand the repercussions of allowing the US Government to default of Treasury debt. While the brinksmanship politics are great fodder for nightly news programs, the reality is that we have faced a debt ceiling deadline 78 times in our history since 1960. They all have been resolved. It’s worth noting that they all seem calamitous at the time. In 2011, for the first time in US history, US sovereign debt was downgraded from AAA to AA+. However in contrast to what you might imagine, US Treasury bonds actually rallied into the event and continued their ascent 12 months hence. Ok, but what if the government is forced to close and we have to furlough federal employees? This also has happened. In fact there have been ten such circumstances since 1980, the longest of which lasted 35 days. 2013 is pictured below because it involved a furlough of a record 800k government employees. 12 months post the event, the US equity market was 20.7% higher. Here is our bottom line. We don’t dispute that the June 1 deadline imposed by US Treasury Secretary Janet Yellen may be breached, or that we may see US debt downgraded, or that a government shutdown may follow. Our simple message is that all of these have occurred before and the market quickly recovers. This time will be no different.

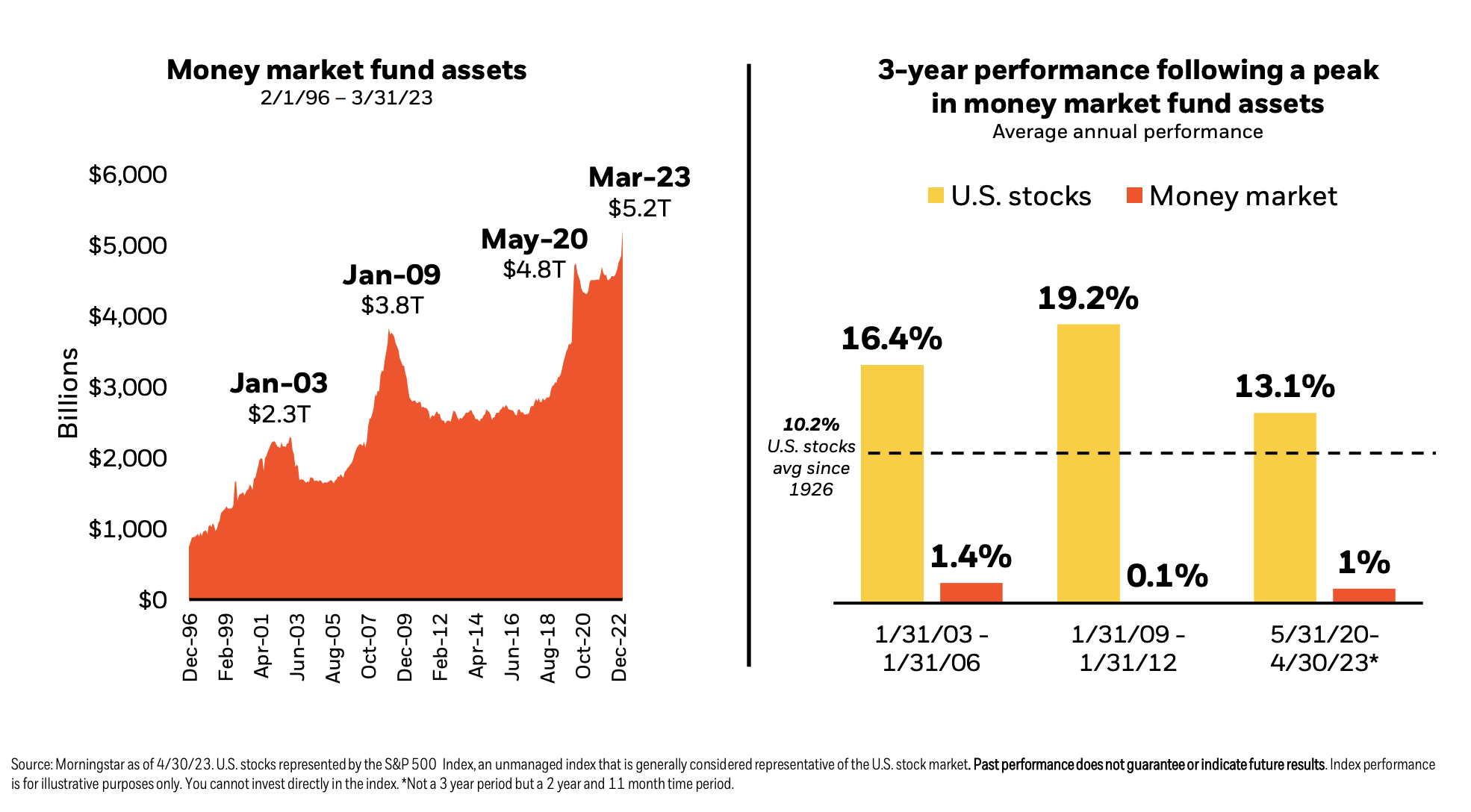

The second most frequent question that we receive from clients is the following. Why don’t we just hide out in money market funds until all these issues are resolved? After all, money market funds are paying our 4.7% per annum. The answer is simple. The cost of being out of the market is material is we get our timing wrong. The reality is that a huge proportion of individual investors have already voted with their feet and are cautiously position. Money market funds have accumulated $5.2 trillion in assets under management. That is $400 billion higher than the peak during the pandemic (when the SPX fell under 2200). For context, the entire market capitalization of all stocks comprising the New York Stock Exchange is $22 trillion. In other words, nearly ¼ of the equity market is now sitting on the sidelines. As investors regain confidence, they will deploy those monies. As the chart on the right depicts, the redeployment of idle cash has produced rather significant 3 year returns in equities. We don’t want to miss that wave.

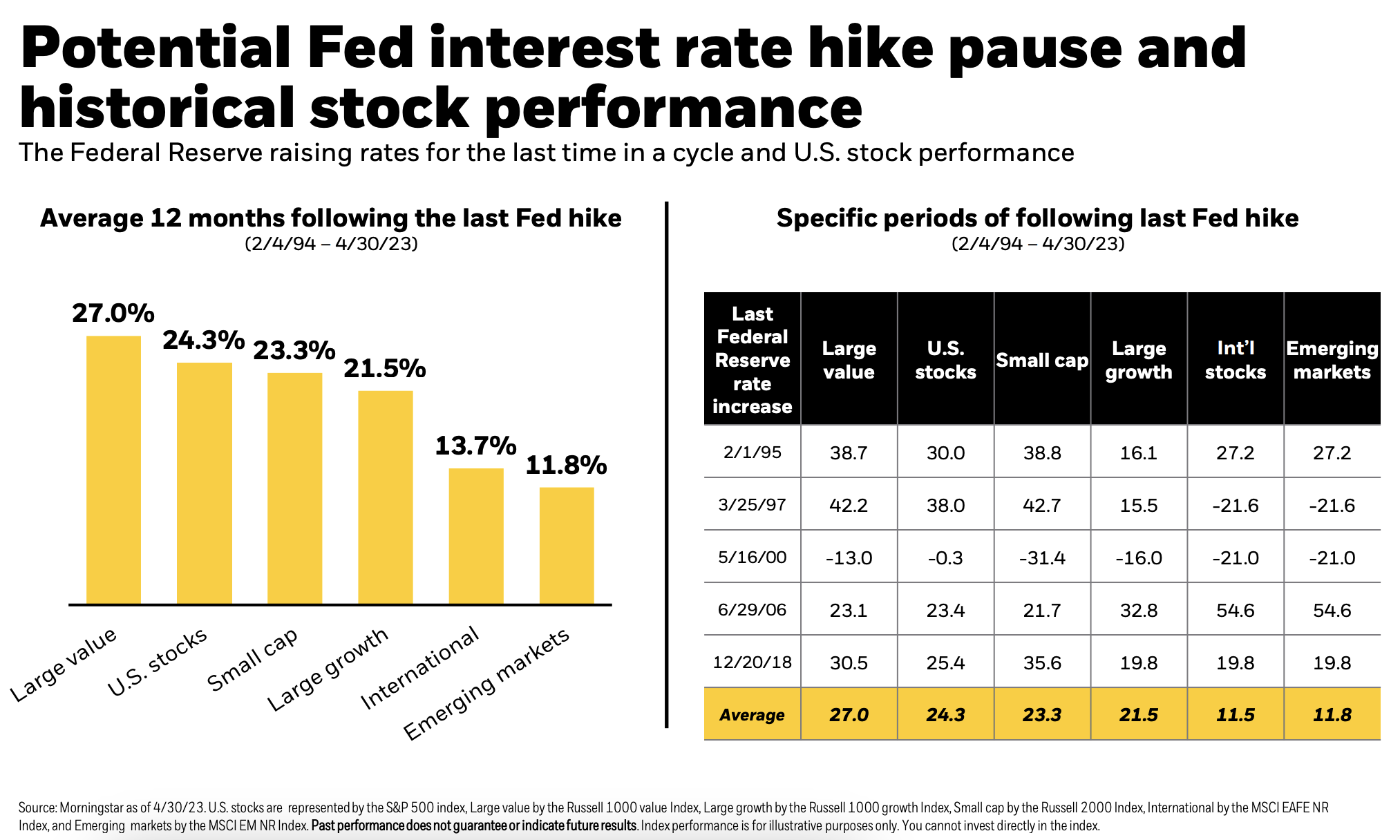

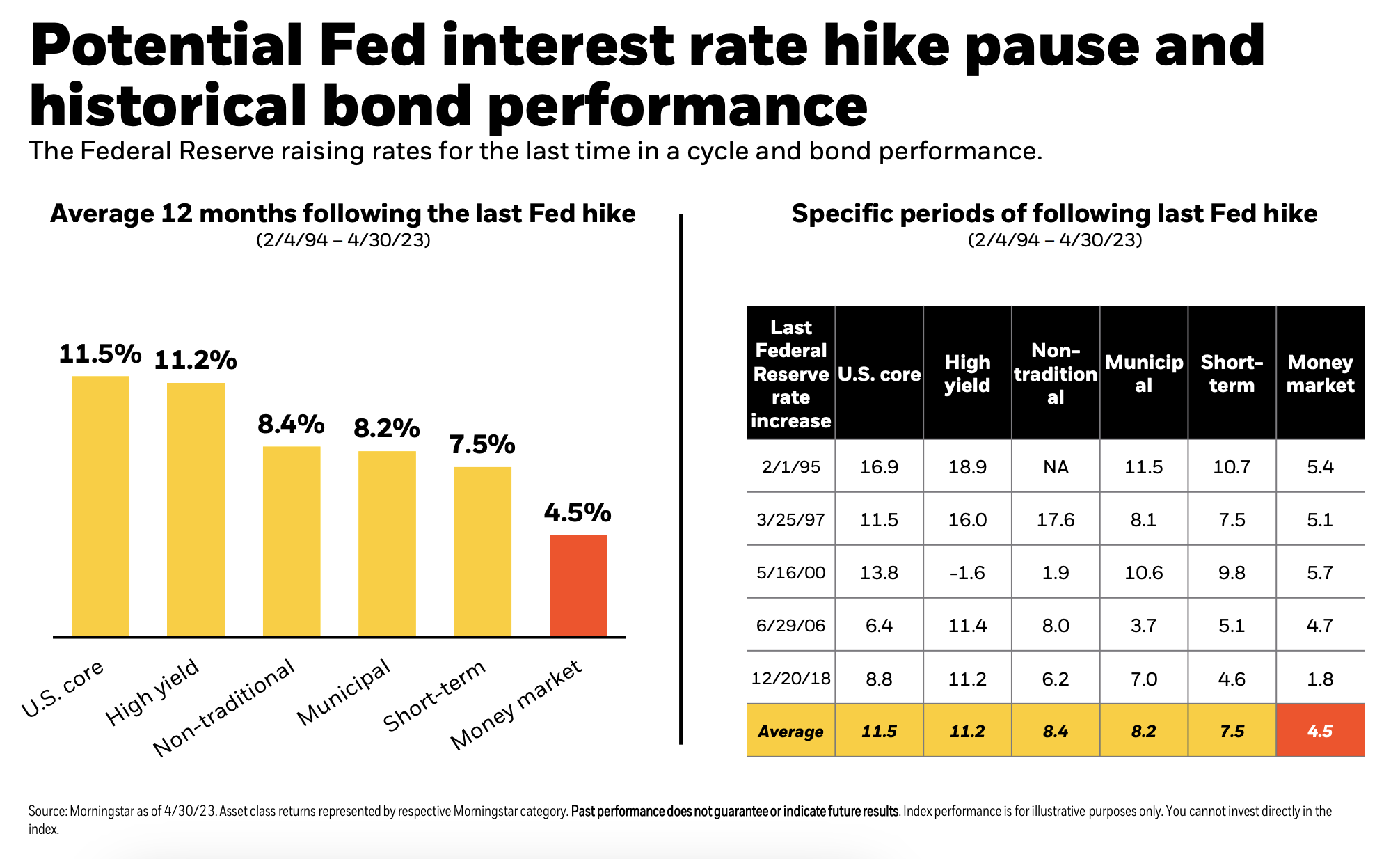

Third and finally, interest rate pauses have been rather significant inflections for the performance of both stocks and bonds. As we continue to argue, inflation is long past peak and continues to decrement lower. The Fed has already told us that they want to see progress on the path to achieving long term targeting inflation of 2%. We believe those signposts will become rather obvious. With the ongoing concerns about the health of the banking system and the rapid decline in bank lending, we believe the Fed will be forced to pause its tightening cycle. That has enormous implications for equities and fixed income if past proves to be prologue. As the following two illustrations show, equities on average are up sharply in the twelve months following the conclusion of a Federal Reserve tightening campaign. The same can be said for bonds, pictured in the second illustration below.

Bond performance depicted below.

Wrapping this up, there is always something to fear in markets. I’ve been employed in the financial services industry for 30 years and a student of market for longer. I can’t recall a time when there wasn’t a wall of worry to climb. However, unequivocally over the years, I have learned that the points of maximum pessimism and confusion often end up being powerful inflection points. While we may be in for some near-term volatility in the short run, the long run remains our focus, and historical precedent is strongly on the side of optimism.

This commentary in this post reflects the personal opinions, viewpoints and analyses of the Westshore Wealth employees providing such comments, and should not be regarded as a description of advisory services provided by Westshore Wealth or performance returns of any Westshore Wealth Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing herein constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Westshore Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.